- The USD/CAD pair remains bullish despite the current drop.

- A strong consolidation could bring new long opportunities.

- Only a new lower low could activate a bearish reversal.

The USD/CAD price is trading in the red at 1.2994 at the time of writing. After its strong rally, the pair found a strong supply, so a temporary drop is natural. It could come back down to test the immediate support levels before resuming its growth. The bias remains bullish despite temporary declines.

-Are you interested in learning about forex live calendar? Click here for details-

As you already know, the pair rallied as the Dollar Index rebounded after its last drop. Now, the DXY drops again. That’s why the USD is losing ground versus its rivals. DXY’s deeper drop should force the greenback to depreciate versus other major currencies. Still, don’t forget that the retreat could be only a temporary one. The FED is expected to continue hiking rates, so the USD could retake the lead soon.

Fundamentally, the USD was punished by Friday’s Capacity Utilization Rate and Industrial Production data. On the other hand, the CAD was supported by the RMPI and by IPPI indicators.

Today, the US banks are closed in observance of Juneteenth National Independence Day. Tomorrow, the Canadian Retail Sales indicator is expected to report a 0.8% growth, while Core Retail Sales could register a 0.5% growth.

USD/CAD price technical analysis: Downside correction

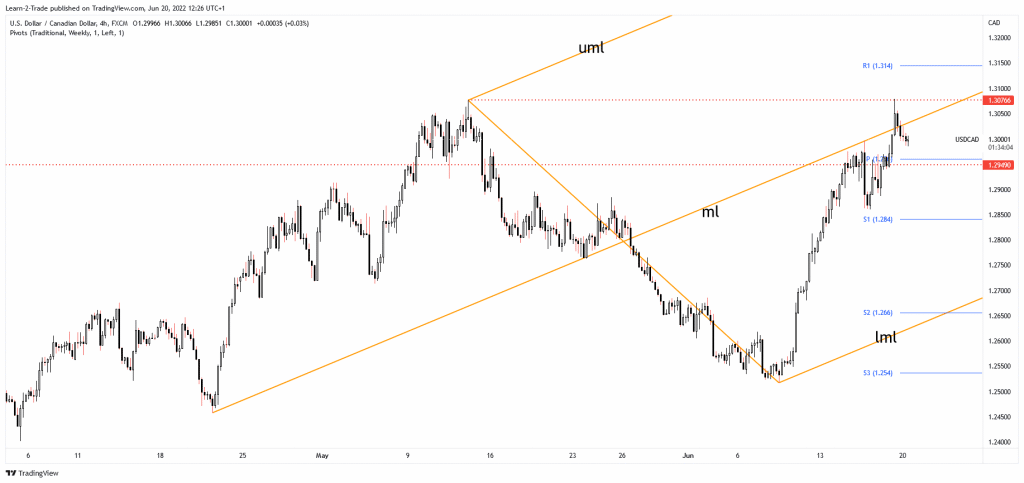

As you can see on the 4-hour chart, the bullish momentum was stopped by 1.3076 higher high, representing a major static resistance. The USD/CAD registered only a false breakout through the ascending pitchfork’s median line (ml).

-Are you interested in learning about forex signals? Click here for details-

The weekly pivot point of 1.2960 and 1.2949 is seen as immediate downside obstacles. As long as it stays above this key level, the rate could resume its growth. A valid breakdown could open the door for a larger drop. Strong consolidation above the near-term downside obstacles could bring new long opportunities.

The price drops, trying to accumulate more bullish energy before approaching the 1.3076 resistance again. An upside continuation will be confirmed by a new higher high. On the other hand, a downside reversal could be activated by a valid breakdown below 1.2860.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money