- Wednesday’s trading saw USD / CAD fluctuate in a range.

- A significant uptrend in crude oil prices supported the Canadian dollar.

- Fed’s restrictive forecast bolstered the dollar and extended support for the pair.

The USD/CAD price remained limited in a narrow trading channel just above the 1.2900 level at the start of the European trading session.

–Are you interested to learn more about Forex apps? Check our detailed guide-

According to investors, vaccines may be more effective than originally thought in the fight against the Omicron variant of Coronavirus. It has also benefited crude oil prices, supported the commodity-pegged Canadian dollar, and limited the upside potential of the USD/CAD pair.

However, the decline is offset by underlying bullish sentiment against the US dollar, supported by the Fed’s restrictive outlook. According to the scatter plot, Fed officials expect to hike the key rate at least threefold over the coming year.

In the meantime, the renewed decline in US Treasury yields failed to impress the US dollar bulls and failed to support the USD/CAD pair. However, the fundamentals seem to favor bullish traders and support the expectation of some decline in buying around the pair.

Later in the North American session, the Conference Board will release its US Consumer Confidence Index and the final pressures on US Q3 GDP. In addition to this, the yield on US bonds will affect the US dollar and give USD/CAD some momentum.

Additionally, traders will continue to monitor the dynamics of oil prices to identify short-term opportunities for USD/CAD. However, intraday moves are likely to remain relatively limited for the rest of the year, given the relatively weak liquidity conditions.

–Are you interested to learn more about STP brokers? Check our detailed guide-

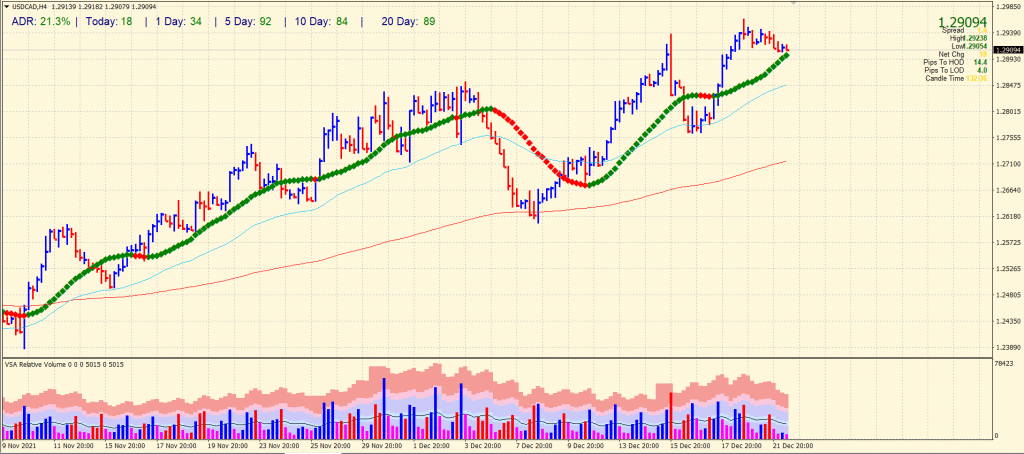

USD/CAD price technical analysis: No clear direction

The USD/CAD price is wobbling around the 0-period SMA on the 4-hour chart. The price remains supported above 1.2900 handle despite slipping from the swing highs of 1.2964. The average daily range is only 21% so far, which indicates a lack of interest from the market participants. Hence, the price is expected to stay within the 1.2850 to 1.2965 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.