- USD/CAD remains under selling pressure below 1.2700 area.

- Improved risk sentiment weighs on the safe-haven dollar.

- Increased demand for WTI lends more room to the oil-pegged Canadian dollar.

As risk sentiment remains moderate, the USD/CAD price stays below the 1.2700 level and finds resistance in the broad US dollar correction. Currently, the US dollar index is trading at 94.07, down 0.21% daily.

-If you are interested in forex day trading then have a read of our guide to getting started-

The market is concerned about a US government shutdown in the final quarter of 2021 amid a delay in the vote on the infrastructure bill. Moreover, investors are nervous about the possible consequences of Evergrande and the looming stagflation threat.

Spot oil also benefits from a slight decline in WTI oil prices from the three-year highs of USD 76.50. There are reports that OPEC is considering increasing oil production to counter persistent supply cuts. In addition, China’s willingness to buy more oil to meet its growing energy needs flattens the downward trend.

In July, Canada’s economy grew by 0.1%, compared with forecasts for 0.2%. According to the latest figures, the economy grew by 0.6% instead of 0.7% in June. However, Canadian economic growth was in line with expectations.

More focus is now on the US ISM Manufacturing Index, the Fed’s most popular PCE inflation indicator, and the Canadian GDP report, which opens up new trading opportunities.

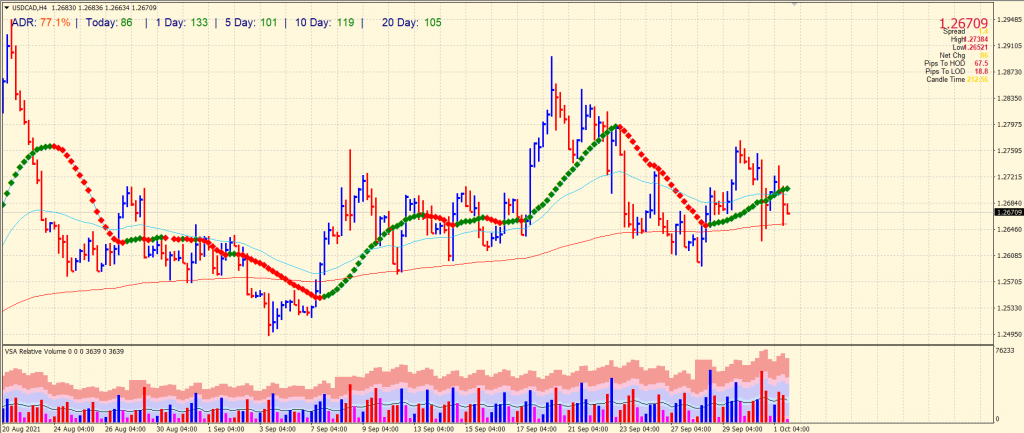

USD/CAD price technical analysis: Bears dominating below 1.2700

The USD/CAD price remains well below the 1.2700 mark, keeping the pair’s bearish momentum alive. However, the price finds respite around the 1.2650 level (200-period SMA) on the 4-hour chart. The bulls are barred by the 20-period and 50-period SMAs.

-Are you looking for automated trading? Check our detailed guide-

The average daily range is so far 77% which shows high volatility. The volume data shows no clear direction as the close of bars is around the middle, which doesn’t help find a trend. The support levels are at 1.2650 ahead of 1.2600 and 1.2570.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.