- Higher crude oil prices are pushing the USD/CAD lower.

- China’s opening-up will boost oil demand and push the pair lower.

- A weak dollar also supports lower prices.

The USD/CAD price ticks lower as Monday morning has seen crude oil prices tick higher amid the dollar’s weakness. Oil strength bodes well for the Canadian dollar as Canada exports more expensive oil.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Last week’s crude oil inventories came in lower than expected, signaling an increase in demand for the product in the US. An increase in demand for oil means higher prices, which means a stronger Canadian dollar.

China’s oil demand has also gone up as China relaxes COVID restrictions. One of the most affected cities, Shanghai, plans to reopen on June 1. There is no doubt that this would boost crude oil prices as China is one of the largest importers of the product. This reopening could also see oil prices going up and USD/CAD prices going down.

A weaker dollar would also support a move lower for USD/CAD. Investors expect the dollar index to weaken this week after showing a lot of bearish momentum on Thursday. There is not much expected to come out of Canada in essential news releases this week. Investors will be looking at dollar news releases coming out on Wednesday.

Bearing all this in mind, we could see USD/CAD pushing lower today. However, everyone will be waiting to see a break below the 1.2500 level.

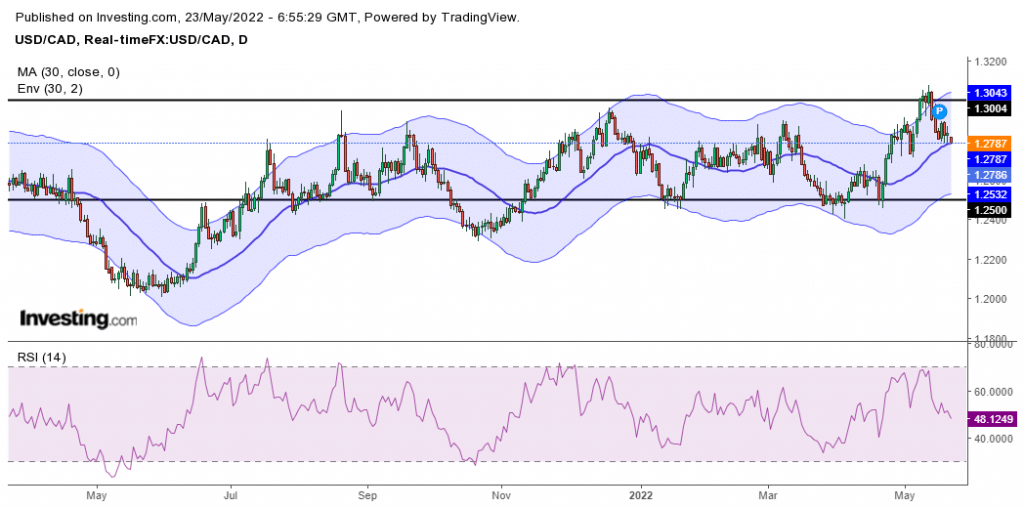

USD/CAD price technical analysis: Stuck within the range

The range in the 4-hour chart is clearly shown by how the price keeps falling through the 30-SMA. Neither the bears nor the bulls are committed. It is also seen in how RSI is stuck between the 30 and 70 levels, neither getting oversold nor overbought.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Bears would take charge if the price were to break 1.2500 and get to the oversold level below 30. On the other hand, bulls would win if they could get the price above 1.3000 and the RSI above 70. The price is currently at 30-SMA, and we could use this as support within the range. If this happens, then we could see a break of 1.3000. If the price breaks through the SMA, we could see it going to 1.2500 and possibly breaking through to the lower side.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money