- USD/CAD is maintaining the bid tone.

- The bounce-back of Greenback lent support to the USD/CAD.

- Fed meeting minutes can provide fresh impetus to the market.

- Canadian employment report can be a big risk event for the pair this week.

The USD/CAD pair found traction on Tuesday as the Greenback bounce back. However, downbeat US ISM Services PMI data couldn’t lend support to the sellers. The price marked a 2-month top near the 1.2500 level, where it found some profit-taking and closed in the positive zone for the day above mid-1.2400.

US data front

The US ISM Services figures came at 60.1 against the expectations of 63.1. Although the data is slightly negative, the market ignored the data, and Dollar bulls kept roaring until the session’s close. Thus, despite a smaller corrective upside in the Asian session today, the Dollar king seems back to the throne during the earlier European session.

Increased US inflation looks like a natural phenomenon now as the markets have apparently digested the impact. Higher inflation could not help gold to rise as a safe-haven asset. However, Greenback is maintaining its positive tone amid risk-aversion.

Sliding crude oil prices

The crude oil prices went sharply towards $77 on Tuesday but could not hold gains and slid to the $73 area. It weighed on the Loonie as a correlating asset. Any increase in oil supply will further pressure the Canadian Dollar.

What’s next for USD/CAD?

The Fed meeting minutes are due today in the NY session. But, first, we have to find the consensus of members on policy tightening in the light of the recent US labor market report.

On Friday, we have employment data for Canada, which may provide fresh impetus to the market. The market expects a rise in jobs and decreased unemployment rate. If the market meets expectations, we can see a surge in Canadian Dolla across the board.

USD/CAD technical outlook: Key levels to watch

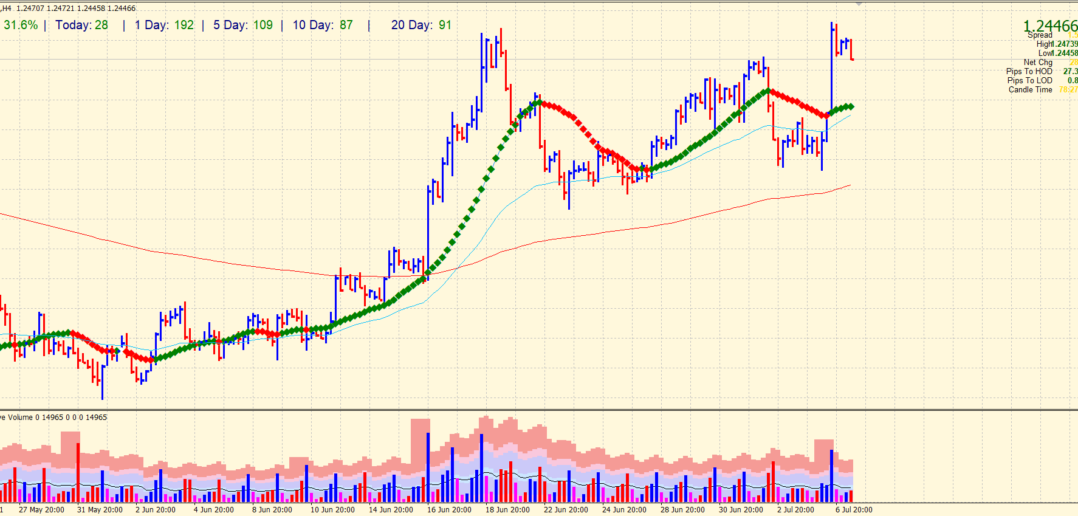

The USD/CAD pair is maintaining a bid tone above 20-period SMA on the 4-hour chart. It seems like prices are now trying to counter-balance yesterday’s sudden rise. However, any slide will be a good buying opportunity for the traders because the price is well above 20, 50 and 200 SMAs on the chart. However, it is important to watch whether the current correction can extend below the 20-SMA or not.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.