- The US Federal Reserve unanimously decided to keep interest rates unchanged in June.

- The US added fewer jobs than expected last month.

- Most economists predict the Bank of Canada will increase interest rates by 0.25%.

The USD/CAD weekly forecast is slightly bearish as investors expect a hike from the Bank of Canada next week. However, it’s important to watch the tone of the bank.

Ups and downs of USD/CAD

The beginning of last week was marked by holidays in the US and Canada, resulting in thin trading. However, the market later picked up on Wednesday when the US released the FOMC meeting minutes.

-If you are interested in brokers with Nasdaq, check our detailed guide-

In their June meeting, the US Federal Reserve decided to keep interest rates unchanged. This decision allows policymakers to evaluate the necessity of future rate hikes.

However, the biggest move came on Friday when the nonfarm payroll report came out. Notably, the US added fewer jobs than expected which saw USD/CAD pull back sharply from its weekly highs.

Next week’s key events for USD/CAD

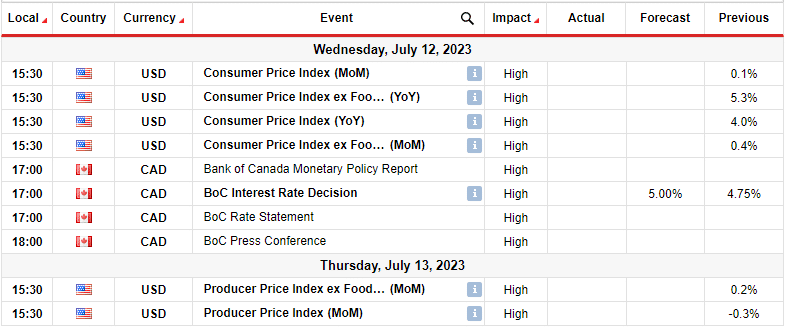

Next week will be important for USD/CAD as there will be several key economic releases from the US and Canada. The US will release inflation data that will affect the outlook for Fed interest rates. On the other hand, the Bank of Canada will hold its policy meeting where it might hike interest rates.

According to a Reuters poll, most economists predict the Bank of Canada will increase interest rates by 0.25% in its upcoming meeting on July 12. This would mark the second consecutive meeting with a rate hike, bringing the rate to 5.00%. Moreover, economists expect the bank to maintain this rate throughout 2024.

USD/CAD weekly technical forecast: Bulls face strong opposition at 1.3350.

On the daily chart, USD/CAD pushed above the 30-SMA in a sudden shift in sentiment. However, the price could not go above the 1.3350 resistance level as bears returned with a strong bearish candle. Nonetheless, the price is still above the 30-SMA, a sign that bulls might still have a chance to take over.

If the 30-SMA acts as support in the coming week, the price will bounce higher and likely take out the 1.3350 resistance level. This would clear the path for bulls to climb to the next resistance at 1.3600. However, if bears break below the 30-SMA, we might see a break below the 1.3201 and a return of the previous bearish move.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.