- The BoC raised rates to a 14-year high.

- Investors expect the Fed to deliver a 75bps rate hike this month.

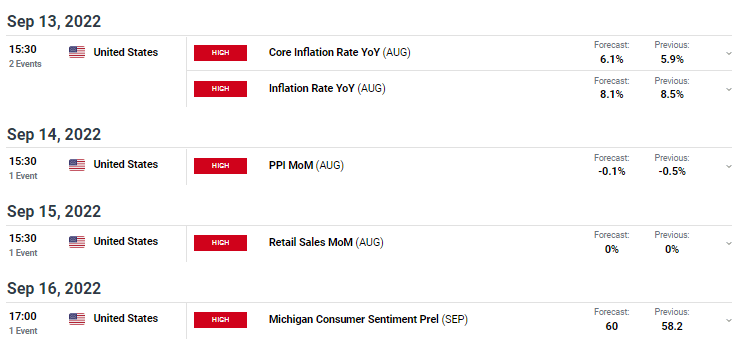

- US Inflation is expected to drop slightly in August.

The USD/CAD weekly forecast is bearish. The pair might extend losses as the Canadian dollar strengthens after the rate hike.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

Ups and downs of USD/CAD

The pair closed the past week lower, showing the Canadian dollar was stronger than the US dollar. Monday and Tuesday were sloe days for the pair. On Wednesday, the Canadian currency plummeted to its lowest level versus the US dollar in almost eight weeks before recovering a good portion of the loss. Investors assessed how much further the Bank of Canada would tighten monetary policy.

In line with expectations, the BoC increased interest rates by three-quarters of a percentage point to 3.25%, a 14-year high.

Investors in contracts linked to the Federal Reserve’s policy rate expect a 75-basis-point increase. This expectation increased throughout the day as a result of the European Central Bank raising its policy rate by three-quarters of a percentage point, a decrease in weekly jobless claims in the United States pointing to continued strength in the labor market, and an unusually hawkish statement from a Fed official who normally opposes increases in interest rates.

Data released on Friday showed that In August, Canada lost employment for the third consecutive month. A hint that rising interest rates may be beginning to chill the overheated economy.

Next week’s key events for USD/CAD

Investors will pay a lot of attention to the US inflation data expected next week as it might guide the Fed on its next rate hike. Inflation is expected to drop from 8.5% to 8.1%.

USD/CAD weekly technical forecast: Bears positioned for a plunge below the 22-SMA

Looking at the daily chart, we see a wedge pattern with clear support and resistance trendlines. The price got rejected at the 1.31977 level, which fell on the resistance line. Bears then pushed the price lower, pausing at the 22-SMA, which offers solid support. The RSI is also above 50, and a break below will indicate a shift in momentum from bullish to bearish.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

The price is positioned at strong support, and bears must maintain their strength to break below. A break below would mean getting to the support trendline and possibly lower at the 1.27525 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.