- US inflation came in lower than expected at 7.7%, the smallest rise since January.

- Markets have now forecasted an 85% possibility of a modest 50 basis-point interest rate increase.

- The SNB stated that its monetary policy decisions were not based exclusively on its inflation forecast.

Today’s USD/CHF price analysis is bearish, fueled by dollar weakness. The dollar suffered significant losses as a result of lower-than-anticipated increases in consumer prices in the US, which raised hopes that the Federal Reserve could slow down the rate at which it raises interest rates. The annual growth in the US consumer price index was 7.7%, the smallest increase since January and the first time it dropped below 8% since February.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

“After four consecutive 75 basis-point interest rate hikes to tame decades-high inflation, the case is now building for the Fed to moderate its aggressive stance,” said Rodrigo Catril, senior currency strategist at National Australia Bank in Sydney.

According to CME’s Fedwatch tool, financial markets have forecasted an 85% possibility of a modest 50 basis-point interest rate increase following the FOMC policy meeting next month.

Today’s moves might, however, be capped as investors nurse anxieties over China’s restrictions. For the first time since April, China’s daily Covid cases exceeded 10,000, with Beijing’s cases hitting their highest level in more than a year.

USD/CHF key events today

Thomas Jordan, the Swiss National Bank (SNB) chairman, will talk. He has a significant impact on the value of the Swiss franc as the chair of the SNB Governing Board, which determines short-term interest rates. Traders pay close attention to his comments since they are frequently used to drop signals about future changes in monetary policy and interest rates.

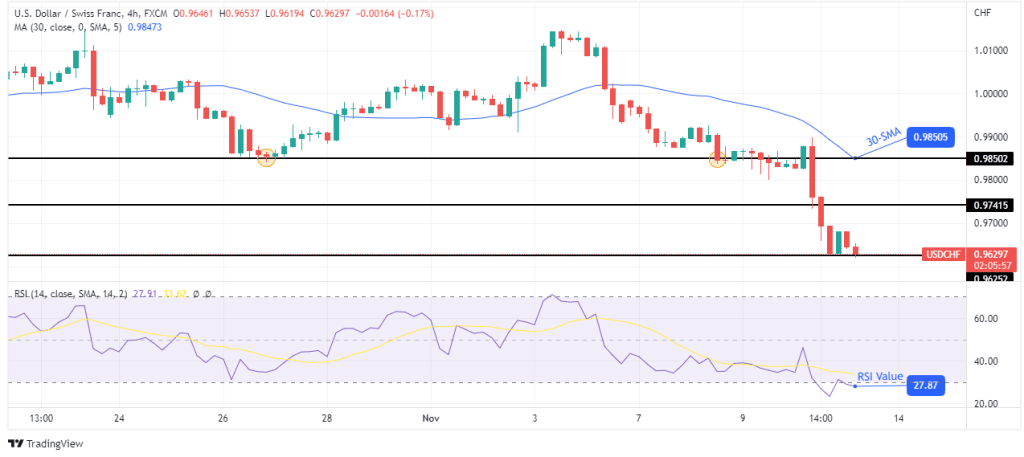

USD/CHF technical price analysis: Freefall set to continue after the pause

The 4-hour chart shows the price trading far below the 30-SMA and the RSI in the oversold region. This is a sign that bears are quite strong. The price has made strong momentum candles in the move down and has paused at the 0.9625 support level. At this point, the price will likely consolidate before breaking below the support and pushing lower.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

However, if bulls return to this support, the price might increase to retest resistance at the 0.9741 key level. The bearish bias will remain as long as the price keeps trading below the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.