- Investors are expecting a peak in US inflation.

- Consumer expectations for inflation in the US went down in August.

- Bets for the Fed’s rate hike are split between 75 and 50bps.

Today’s USD/CHF price analysis is bearish as the greenback suffered losses in anticipation of US inflation data that may indicate some signs of easing.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

At 12:30 GMT, the United States will release data on inflation. According to consensus, the core inflation rate increased by 0.3% from one month to the next in August. Recent dollar gains have decreased as investors expect a peak in US inflation.

The New York Fed’s monthly poll of consumer expectations revealed on Monday that American consumers’ expectations for inflation decreased further in August due to falling gas prices.

“The outcome of the CPI is going to be important for the Fed … it would probably take an acceleration, a strong outcome in the CPI, to see them hike by 75 basis points,” said Kristina Clifton, a senior economist and senior currency strategist at Commonwealth Bank of Australia.

“If we get a reading sort of broadly in line with what the consensus is expecting, we would say they would go for a 50 basis point increase.”

USD/CHF key events today

Investors are awaiting the US CPI data. The Consumer Price Index (CPI) monitors changes in prices for products and services as seen through the eyes of the consumer. It is an important tool for evaluating changes in inflation and purchasing habits. It is expected to drop from 8.5% to 8.1%.

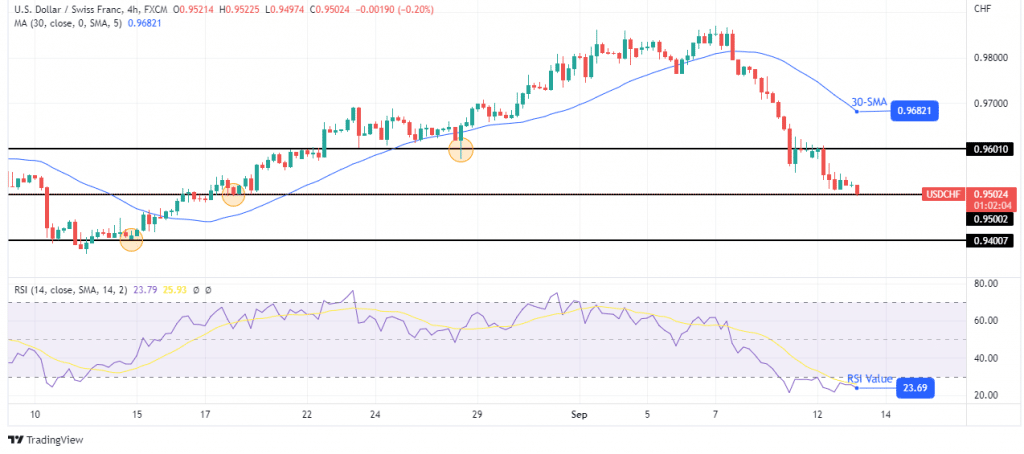

USD/CHF technical price analysis: Bears keep breaking below solid support levels

The 4-hour chart shows a strong bearish move, with the price trading well below the 30-SMA and the RSI in the oversold region. This move is steep, showing bears have a lot of momentum. The downtrend started at the break below the 30-SMA, where sellers took over and did not pause till the price broke below the 0.96010 support level.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

A small pullback to retest the support level played out before the price plunged to the next support level at 0.95002. As bears have a lot of momentum on their side, they might break below 0.95002 and head for the next support level at 0.94007. However, if 0.95002 is strong, the price might make a bigger pullback before falling further.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.