Dollar/yen extnded its rises, buoyed mostly by rising US yields. After reaching the highest levels since February, can it continue higher? US GDP and a BOJ decision stand out in the last full week of April.

USD/JPY fundamental movers

Optimism Fed, Trump-Abe meeting

John Williams, the incoming President of the New York Fed, seems very optimistic about the economy and about reaching the inflation target. In addition, data for the US economy remains upbeat. This led 10-year Treasury yields to higher ground, allowing the greenback to rise and rise.

US President Donald Trump met Japan’s PM Shinzo Abe and they did not reach agreements on trade issues. Abe wants the multilateral TPP while Trump insists on bilateral deals. Nevertheless, the focus is on Chinese-US relations rather than US-Japanese ones.

Abe is suffering at home from falling approval ratings and some speculate he may be forced to quit sooner or later. A resignation is likely to boost the yen, as Abe’s policies, aka Abenomics, went a long way to weaken them.

US GDP buildup and the BOJ decision

The US publishes its first estimate for the first quarter on Friday. A slowdown is expected after three upbeat quarters. The biggest hint towards the event comes on Thursday with the durable goods orders. The figure feeds into the GDP read. Also, watch out for existing and new home sales and other US data points.

In Japan, the Bank of Japan convenes early on Friday to make its rate decision on the fifth anniversary of the QQE program. Haruhiko Kuroda’s massive bond-buying scheme sent the yen tumbling down and has helped the economy thrive. The BOJ is unlikely to announce new measures at this point.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

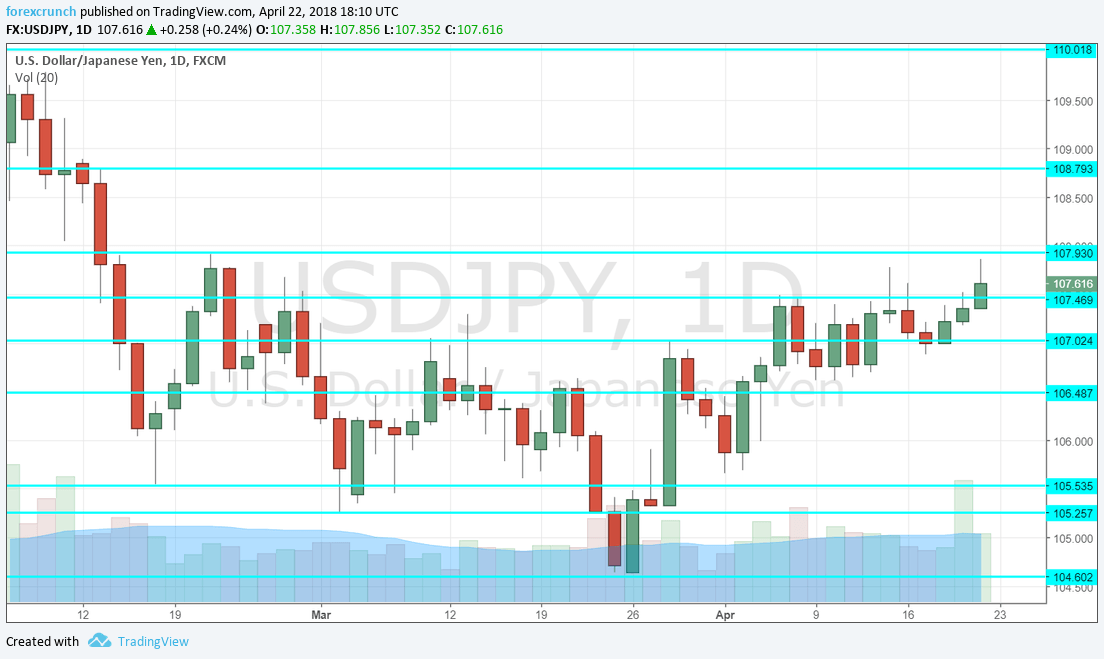

110.70 that was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bullish on USD/JPY

The eagerness of the Fed to raise rates amid rising inflation is not fully priced into the pair. Abe is unlikely to quit this week, so a negative shock to USD/JPY may have to wait.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!