- Japanese government officials are criticizing the BOJ over the yen’s weakness.

- The yen’s weakness is inflating import costs for raw materials.

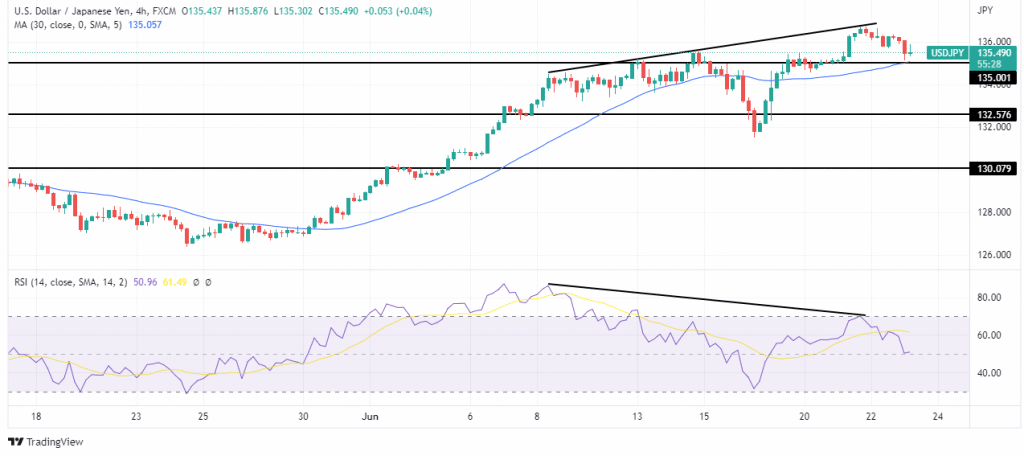

- The bulls are showing weakness in the charts.

The USD/JPY forecast is edging lower on Thursday. The yen is gaining on the dollar as Japan’s government officials criticize the Bank of Japan for a yield cap policy that has seen the yen collapse. The BOJ’s Governor, Haruhiko Kuroda, continues to defend the bank’s 10-year JGB yield cap of 0.25%, insisting low interest rates support the economy.

-Are you interested in learning about forex live calendar? Click here for details-

“Recent moves are very sharp and problematic. The yen could weaken further as the Japan-U.S. interest rate gap widens. We’re seeing a negative spiral in which Kuroda’s comments stressing the need to defend the 0.25% cap are accelerating yen falls,” said Okina, a former BOJ official to Reuters yesterday.

The yen’s weakness is causing inflation in the cost of importing fuel and raw materials.

USD/JPY key events today

USD/JPY investors will be paying attention to the Purchasing Managers Index data from the US, which will show activity levels in the manufacturing and services sectors. The manufacturing PMI is expected to drop from 57.0 to 56.0, while the services PMI is expected to go up by a percentage point to 53.5. They will also expect to hear from Fed Chair Powell, who will go on with his testimony later in the day.

In Japan, investors expect inflation data to show the national core CPI holding at 2.1%. Japan is one of the few countries with low inflation and a relatively dovish central bank. It has seen the yen weaken against the dollar significantly. A surprise in the inflation data could cause some volatility in the pair.

USD/JPY technical forecast: RSI showing weak bulls

Looking at the 4-hour chart, we see the price pushing lower toward the 30-SMA at 135.00. The RSI is showing weakness in the bullish momentum, as seen in how there is a bearish divergence. At this point, the price is also experiencing significant support from the 135.00 critical psychological level. If bulls are weak, as seen in the RSI, bears might be able to push the price below the 30-SMA and 135.00.

-Are you interested in learning about forex signals? Click here for details-

However, if 135.00 holds as support, we could see the price pushing higher to make a new high.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money