- The Bank of Japan will likely maintain its yield curve control policy.

- Investors expect the ECB and Fed to raise rates by 25 basis points during the week.

- There’s confidence in the markets regarding a soft-landing scenario for the US markets.

Today’s USD/JPY forecast is bullish. Investors expect the Bank of Japan to be the outlier among central banks as policymakers in Europe and the United States raise rates. The Federal Reserve’s meeting concludes on Wednesday, followed by the European Central Bank a day later and the Bank of Japan on Friday.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Notably, the yen experienced a sharp decline last week against the US dollar and other currencies. This decline followed a Reuters report suggesting the Bank of Japan would likely maintain its yield curve control policy.

Meanwhile, investors anticipate the ECB and Fed to raise rates by 25 basis points during the week. However, the focus lies on these banks’ signals about their plans for the September meetings.

Bob Savage from BNY Mellon stated that the events of the last week have instilled confidence in the markets regarding a soft-landing scenario for the US markets. In this scenario, the Fed concludes its rate hikes. Subsequently, it witnesses a gradual decline in the Consumer Price Index without leading to a recession.

Elsewhere, the Commonwealth Bank of Australia analysts stated that if the BOJ modifies its YCC program, financial markets will interpret it as the beginning of a policy tightening cycle. Under such circumstances, they predict that USD/JPY and EUR/JPY could decline by about 2-4 yen on the day.

USD/JPY key events today

Traders will closely monitor purchasing managers’ index figures from various regions, including the US. These are scheduled for release during Monday’s trading day.

USD/JPY technical forecast: Buyers prepare to breach the 142.05 resistance.

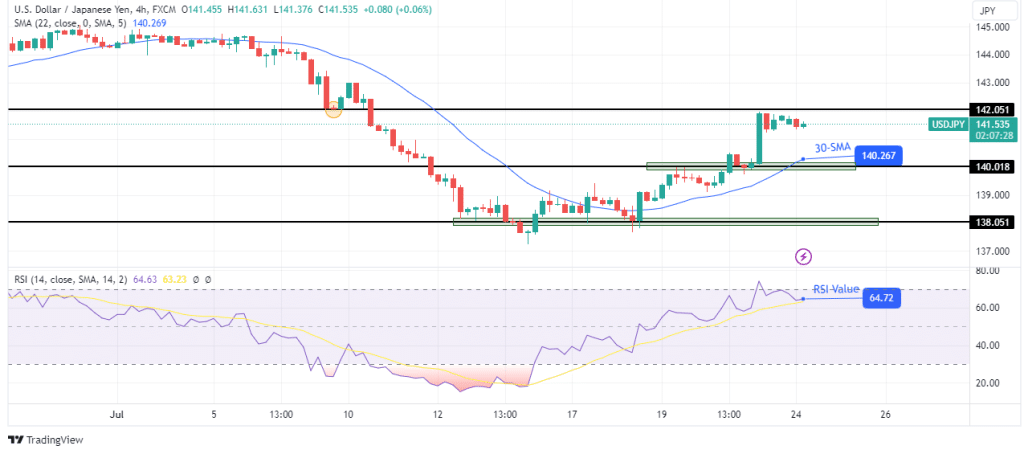

On the charts, USD/JPY is on a bullish trend where the price consistently makes higher highs and lows. At the same time, the price is respecting the 30-SMA as support, showing control lies with the bulls. Furthermore, the RSI points to solid bullish momentum near the overbought region.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

However, after a strong surge from the 140.01 support level, the price has paused below the 142.05 resistance. Since bears are not showing much strength, there is a high chance the price will soon break above the 142.05 resistance to make new highs.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money