Dollar/yen was trading up and down and eventually closed higher, reflecting dollar strength rather than concerns about trade wars. Will this continue? With fewer events in markets, politics will take center stage.

USD/JPY fundamental movers

Trump-Kim Summit, hawkish hike, upbeat data

Donald Trump met Kim Jong-un in a historic summit. While there was little of substance, the slow move toward peace was positively received by the world.

The focus then moved to the Fed which signaled a total of four hikes in 2018 against 3 originally projected in addition to raising the rates. The announcement about holding press conferences after every rate decision and the generally upbeat tone supported helped the dollar. The greenback made its real rally after retail sales came out above expectations.

The Bank of Japan had its rate decision as well but did not rock the boat and is set to keep its very accommodative monetary policy for a very long time.

The week began with acrimony from the G-7 Summit that ended without a communique after US President Trump clashed with Western leaders, especially Canada’s PM Trudeau. And it ended with the US announcing tariffs on China and the latter promising to retaliate. The impact on markets has been limited but may become more significant later on.

Trade, housing, and Powell

While the US and China announced tariffs, these will come into effect only in early July, allowing time for negotiations. The same goes for the EU’s retaliatory tariffs. Will negotiations succeed? This could weaken the yen. However, if Trump continues his tirades, the safe-haven yen could be in demand.

Data-wise, US building permits, housing data, and sales of homes will be of interest in a week that does not feature top-tier data. Fed Chair Powell and BOJ Kuroda will participate in a panel with their euro-zone and Australian peers.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

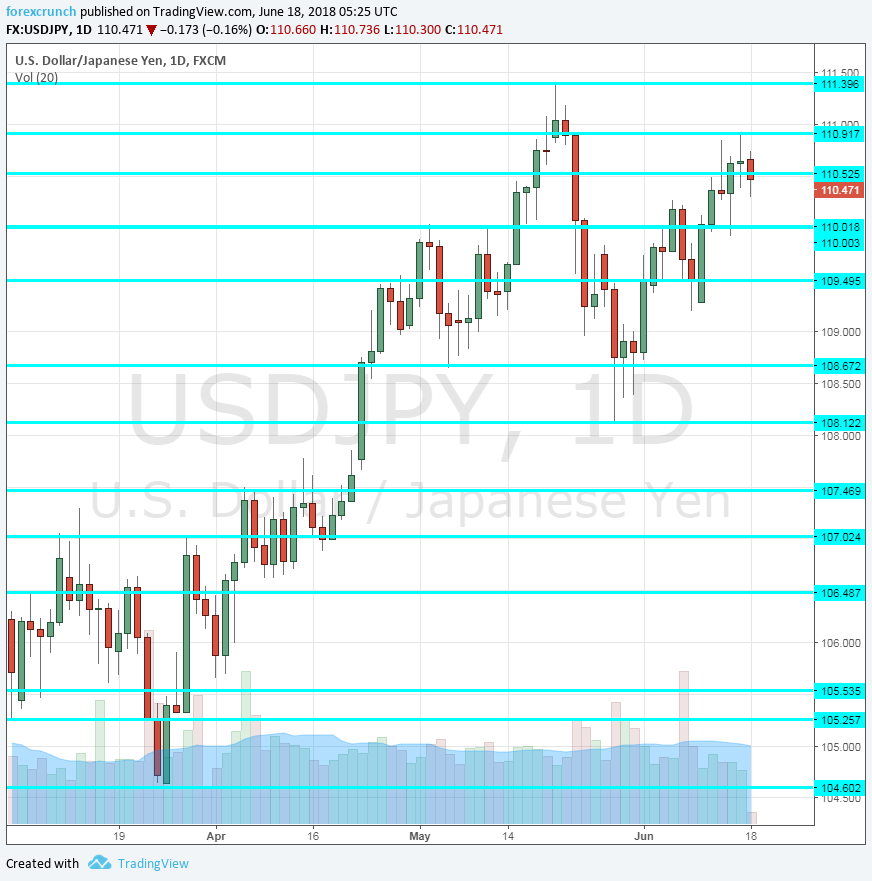

112.20 supported the pair back in December. It is followed by 111.40 which capped the pair in mid-May.

Further down, 110.90 was a high point in February. The round number of 110 serves as a psychological level. 109.50 held the pair back in late April.

109 was a pivotal line within the range. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

Markets are pricing in the hawkish stance by the Fed but not the slow motion train wreck that is the trade war. The safe-haven yen could come in demand soon.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!