- The yen is plunging against the dollar on a dovish BoJ.

- The BoJ has promised to keep a close eye on the yen.

- The USD/JPY pair is experiencing resistance in the charts.

The USD/JPY forecast turns positive as the pair is rallying on Friday after the Bank of Japan kept its negative policy unchanged, despite pressure from aggressive tightening by other central banks, including the Federal Reserve and Swiss National Bank.

-Are you interested in learning about forex tips? Click here for details-

The central bank said it would “closely watch” the weaker yen’s impact on the economy due to its recent sharp declines.

USD/JPY key events today

A press conference is being held by the Bank of Japan this morning that investors will pay attention to for clues on the bank’s monetary policy. The Bank of Japan is one of the few central banks that has refused to follow the path of raising interest rates to control inflation.

Japan’s inflation is not as high as the US and the UK; however, the weaker yen affects the country’s trade balance. Japan’s policymakers have said they would be ready to act appropriately if the yen further weakens.

Investors will also be listening to Fed Chair Powell, who is expected to speak later in the day. Finally, the Fed monetary policy report, containing discussions of “the conduct of monetary policy and economic developments and prospects for the future,” will be released later in the day.

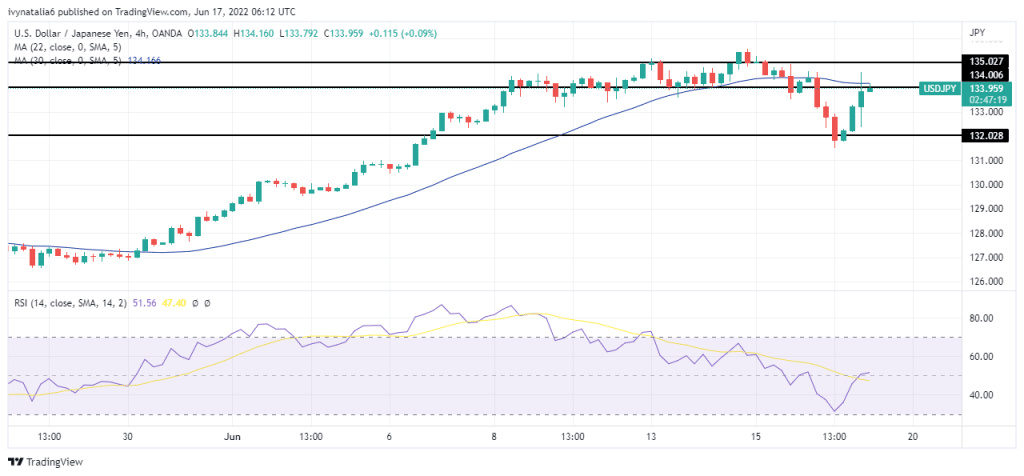

USD/JPY technical forecast: Bulls retesting the 30-SMA

Looking at the 4-hour chart, we see a change in the trend. This change is clearly shown by how the price broke below the 30-SMA and has pulled back for a retest. If the SMA can hold the price by acting as resistance, we could see the price hitting the subsequent low below 132.00. This move would then start a series of lower lows and lower highs that would confirm a new bearish trend.

-Are you interested in learning about the forex basics? Click here for details-

The price is currently experiencing resistance from the 30-SMA at 134.00. A break above this level could see the price hit and go beyond 135.00 to make a new high. Finally, we see the RSI trading at around 50, which could act as resistance. If the RSI starts trading below 50, the trend will remain bearish, but above 50 would mean a bullish trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money