Dollar/yen advanced nicely as trade wars took a step back, US yields climbed and the Fed remained hawkish. But not everything is going in favor of the pair.

USD/JPY fundamental movers

Fewer concerns but also a potential change of policy by the BOJ

The deadline came and went and the US did not impose new tariffs on China. On one hand, Trump threatened to add additional ones. On the other hand, Treasury Secretary Steven Mnuchin initiated talks with China. Does he have the backing of Trump? Probably not, but Trump is busy with Florence, the hurricane pounding the Eastern seaboard.

Emerging markets are also calmer with Turkey finally raising rates and no new adverse developments in other countries. Argentina continues negotiating with the IMF.

The Federal Reserve remains hawkish with both Brainard and Evans hinting that interest rates may go beyond neutral, aka higher than inflation. Inflation actually dropped: Core CPI fell from 2.4% to 2.2%, temporarily weighing on the greenback. Retail sales were mixed with a miss on the headline but with substantial upward revisions. Consumer confidence beat expectations with 100.8 points.

Japanese Prime Minister Shinzo Abe, preparing for an internal leadership contest within his party, said that loose monetary policy will not last forever. Is the BOJ about to tighten? Not so fast, but the yen may react positively.

Housing data, the BOJ, maybe trade developments

The upcoming week is somewhat more quiet with housing starts, building permits, and existing home sales to provide an update on the housing sector. The Philly Fed Manufacturing Index is also of interest.

The Bank of Japan convenes for the first time after Abe’s comments. Will we see a change of tone? In any case, the loose monetary is unlikely to see any change, at least not now. The interest rate is projected to remain at -0.1% and the BOJ will likely continue targeting the 10-year yield.

Trade may come back into play. Markets will want to hear good news from the negotiations, but these may never come. It all depends on Trump.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

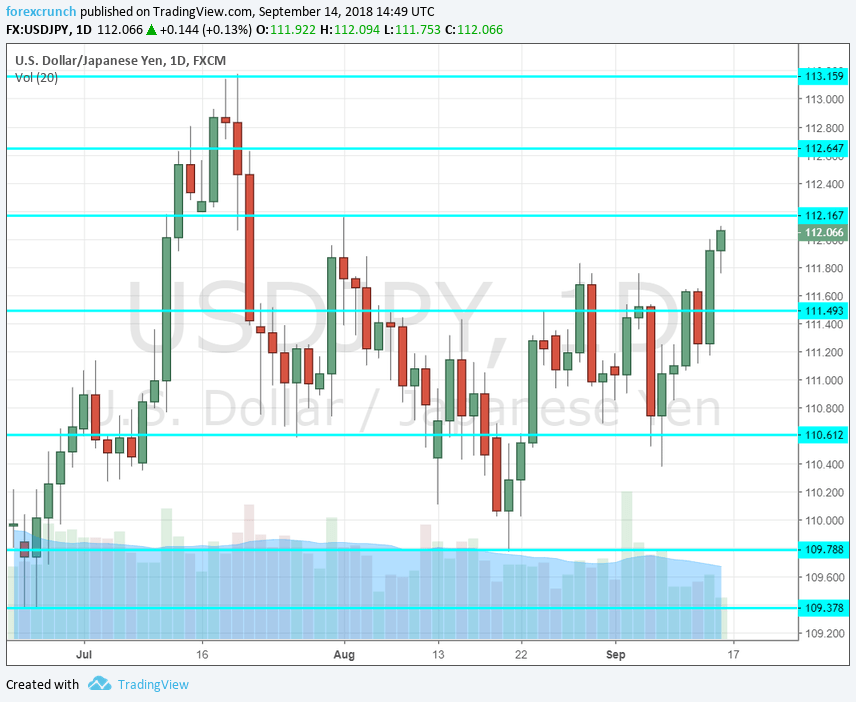

113.15 is the high point seen in July. 112.45 was a stepping stone for the pair when it traded on such high ground. 112.15 was a swing high early in the month.

111.80 was a peak in the dying days of August and serves as resistance. Close by, 111.50 capped the pair beforehand and is another barrier.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The calm on the trade front is unlikely to last for a long time. In addition, the words of PM Abe will likely boost the yen higher at some point.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!