- US private payrolls rose significantly less than expected in September.

- Longer-term US Treasury yields fell following the US employment report.

- Data from the Bank of Japan’s money market showed that Japan did not intervene in the FX market.

Thursday’s USD/JPY forecast is bearish as the yen found much-needed relief as the dollar weakened in response to mixed US economic data. The data caused investors to dial back their expectations of the Fed raising interest rates again this year.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The greenback relinquished some of its recent gains after Wednesday’s ADP National Employment Report revealed that US private payrolls had increased significantly less than anticipated in September. However, analysts cautioned that more evidence was required to determine the speed at which the labor market was cooling.

Moreover, following the release of this data, longer-term US Treasury yields, which had reached 16-year highs, eased and remained lower.

Moh Siong Sim, a currency strategist at Bank of Singapore, noted, “There are some indications that the US labor market is cooling down further,” However, he emphasized that it was still too early to draw definitive conclusions. Furthermore, he highlighted the significance of closely monitoring Friday’s non-farm payrolls report. Additionally, he noted, “The bigger picture is that overall US growth has been slowing. However, it’s been slowing at a pace slower than expected.”

Dollar/yen, a currency pair sensitive to US yields, was last seen trading around 148.53, reflecting a decrease of approximately 0.4%. Notably, the yen had reached 150.165 on Tuesday, its weakest level since October 2022.

Speculation had arisen earlier that Japanese authorities might have intervened to support the yen’s sharp recovery after it breached the 150-line. However, data from the Bank of Japan’s money market indicated on Wednesday that Japan had likely not intervened.

USD/JPY key events today

Investors will receive one major report from the US.

- The initial jobless claims report.

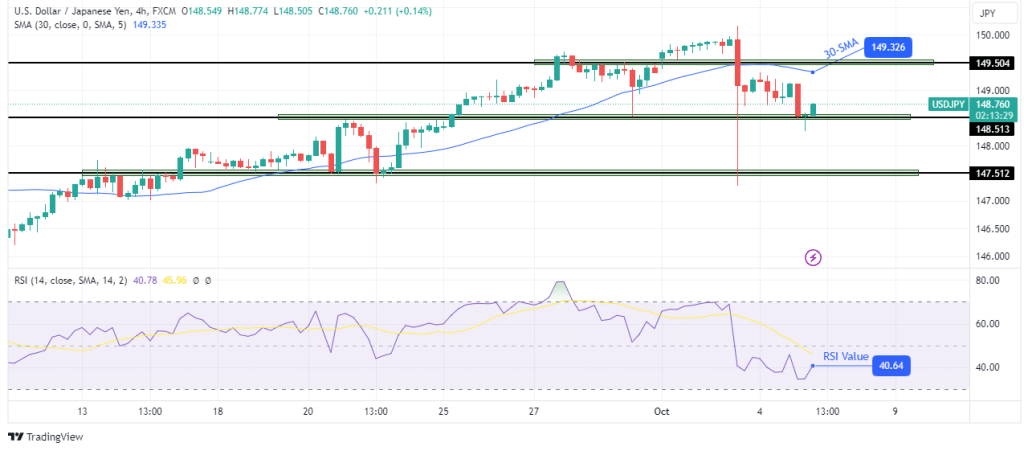

USD/JPY technical forecast: Price revisits 148.51 support level.

On the technical side, the USD/JPY price has retested the 148.51 support level, where bulls have resurfaced. Still, bears are now in control as the price has settled below the 30-SMA and the RSI below 50. Therefore, the pause at the 148.51 level might only be temporary.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

As long as the price stays below the 30-SMA, bears will keep control, likely breaking below 148.51. A break below this level would clear the path for a drop to the 147.51 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money