- Credit conditions in the US tightened at the beginning of the year.

- Ueda noted that Japan’s economy was picking up.

- The BOJ removed its policy guidance to keep interest rates at “current or lower levels.”

Today’s USD/JPY outlook is bullish. The dollar rose slightly following the release of the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey. The survey indicated that credit conditions for US businesses and households had tightened at the beginning of the year. Still, it was likely due to the impact of the Fed’s aggressive rate hikes instead of severe banking sector stress.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

On Tuesday, Bank of Japan Governor Kazuo Ueda announced that the central bank would end its yield curve control policy once inflation prospects rise sufficiently to reach its 2% target.

During his speech in parliament, Ueda noted that Japan’s economy was picking up, and inflation expectations remained high. However, he cautioned about uncertainties in the outlook. This includes the sustainability of recent strong wage growth and its spread to smaller firms.

The BOJ’s yield curve control (YCC) policy establishes a short-term interest rate target of -0.1% and limits the 10-year bond yield at around zero.

Markets speculate that Ueda will phase out YCC soon. However, Ueda has repeatedly dismissed the idea of an immediate interest rate hike. He claims that the recent inflation increase is primarily due to rising import costs rather than strong domestic demand.

During his first meeting as governor last month, the BOJ removed its policy guidance, which previously committed to keeping interest rates at “current or lower levels.” The bank also announced plans to evaluate its past monetary policy measures.

USD/JPY key events today

Investors are not expecting any key releases from the US or Japan, so the price will likely consolidate ahead of the US inflation report.

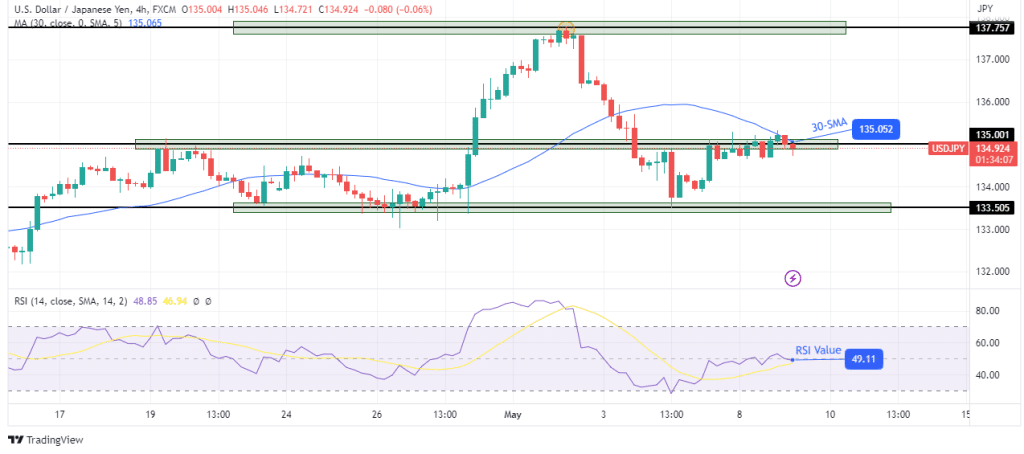

USD/JPY technical outlook: Pullback testing strong resistance zone

In the 4-hour chart, USD/JPY trades at a strong resistance zone comprising the 30-SMA and the 135.00 key level. This comes during a pullback following a bearish impulse leg from the 137.75 resistance level. The bearish move paused at the 133.50 support level, where bulls took over.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

However, the move higher has not been as strong as the bearish move. It might therefore pause at the resistance zone, allowing bears to return and take out the 133.50 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money