- Fed officials indicated that the central bank still has further steps to take.

- There’s a stark contrast between a still-hawkish Fed and an extremely dovish BOJ.

- Money markets estimate a roughly 20% likelihood of another 25bps Fed hike in June.

Today’s USD/JPY outlook is bullish. On Tuesday, USD/JPY hit a six-month high. This occurred as expectations grew that US rates would remain elevated for an extended period, and the impasse over the debt ceiling hurt risk sentiment.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Several influential figures from the Federal Reserve spoke on Monday, and some indicated that the central bank still has further steps to take in tightening monetary policy.

Neel Kashkari, President of the Minneapolis Fed, suggested that US rates might need to exceed “6%” for inflation to reach the Fed’s 2% target. Similarly, James Bullard, President of the St. Louis Fed, stated that the central bank may need to implement an additional half-point rate hike later this year.

The significant rise in USD/JPY highlights the stark contrast between a still-hawkish Fed and an extremely dovish Bank of Japan.

Money markets estimate a roughly 20% likelihood of the Fed implementing another 25-basis-point increase next month. Furthermore, expectations of future Fed rate cuts later this year have been scaled back, with rates projected to remain above 4.7% by December.

In May, Japan experienced significant development in its manufacturing sector, marking the first expansion in seven months. Concurrently, the service sector achieved record growth thanks to strengthening business conditions in the post-COVID recovery phase.

USD/JPY key events today

Investors will receive data from the US focusing on the housing market and the services sector. The building permits, and new home sales reports will show the state of the housing market, while the services PMI will show activity in the services sector.

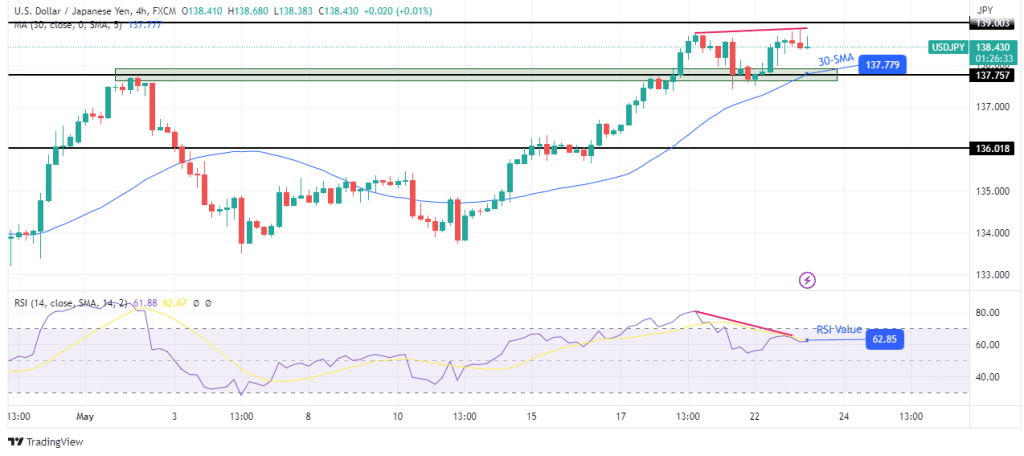

USD/JPY technical outlook: Bulls weaken below the 139.00 resistance.

USD/JPY has made a new high in the 4-hour chart but has failed to retest the 139.00 resistance level. The bullish bias is still strong because the price sits well above the 30-SMA. Similarly, the RSI sits above 50, showing strong bullish momentum.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

However, a closer look at the RSI reveals a bearish divergence with the price. Although the price has a higher high, the RSI has a lower one. This could lead to a retest of the 30-SMA or a deeper pullback, leading to a reversal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.