- Japan’s wholesale inflation decelerated for the fifth month.

- The BOJ believes that consumer inflation will moderate in the coming months.

- The BOJ will likely hold its ultra-loose monetary policy this week.

Today’s USD/JPY outlook is slightly bullish. Data released on Monday revealed that Japan’s wholesale inflation decelerated for the fifth month in May. This was due to declining fuel and commodity prices. This decline indicates a potential easing of cost-driven pressure that has contributed to higher consumer inflation.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

The data supports the Bank of Japan’s perspective that consumer inflation will moderate in the coming months as global commodity prices retreat from last year’s peak. Additionally, the BOJ will likely hold its ultra-loose monetary policy and adhere to its projection of a gradual economic recovery.

Notably, the Corporate Goods Price Index, which gauges the prices charged by companies to one another for goods and services, had an annual increase of 5.1%.

This increase was lower than the median market forecast of a 5.5% gain and followed a revised 5.9% rise in April. Furthermore, the May figures reflected decreases in electricity, fuel, nonferrous metals, and chemical goods prices.

However, the data also indicated that beverages, food goods, and electric equipment prices continued to rise annually. This suggests that cost pressures in sectors closely associated with households have not shown significant signs of easing.

In April, Japan’s core consumer inflation reached 3.4%, driven by ongoing price hikes by companies. Consequently, there is some doubt that inflation will gradually decline to below 2% in the latter half of this fiscal year, ending in March 2024.

USD/JPY key events today

Japan and the US are not set to release key economic reports today, which might result in a quiet session for USD/JPY.

USD/JPY technical outlook: The price is set to challenge the range support.

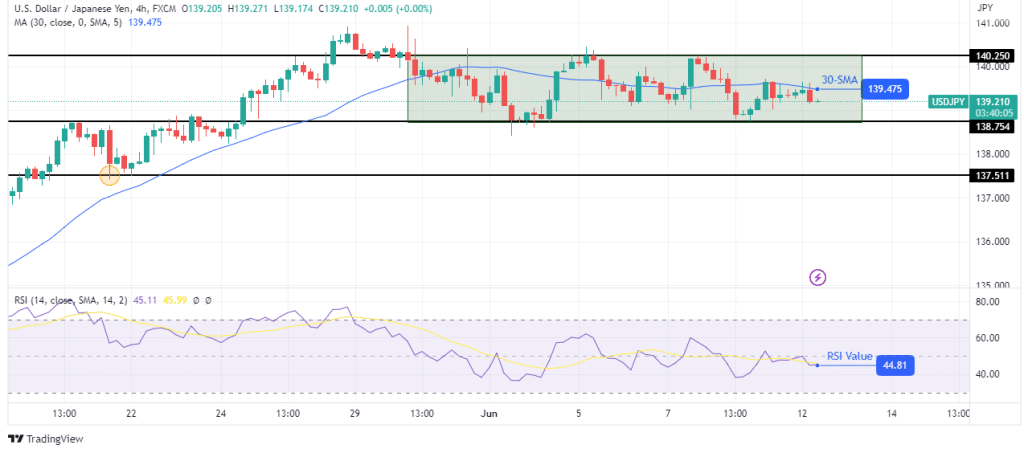

On the charts, USD/JPY is moving sideways, trading between the 140.25 resistance and 138.75 support levels. Additionally, it is chopping through the 30-SMA, another sign of no clear direction in the market.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Within the range, bears have control as the price trades below the 30-SMA and the RSI under 50. This means that soon, bears will retest the range support. If they break below, the price will retest the 137.51 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money