Dollar/yen completely reversed its rises as the global mood worsened around trade and geopolitics. Will it continue falling? The upcoming week features the NFP with few hints, GDP, and other interesting events.

USD/JPY fundamental movers

Fear is back, the Fed is hiking, and Japanese inflation is weak

The week began with a lot of optimism as China and the US announced they put the trade war on hold. The upbeat mood did not last too long though. Trump changed his mind about the detente. In addition, the US President Trump canceled the planned Summit with Kim Jong-un of North Korea amid recent tensions. This also sent the safe-haven Japanese yen higher.

The FOMC Meeting Minutes confirmed the rate hike in June as the Fed said that it would be appropriate to raise rates soon. On the other hand, they may be willing to tolerate higher inflation, thus hinting about a pause in the next months until a potential hike in December. US data was OK with core durable goods orders beating expectations. Housing figures slightly missed expectations.

Japanese inflation for the capital region of Tokyo continued falling and surprisingly hurt the Japanese yen. Japanese data does not always have an impact.

NFP, GDP, and also Kuroda

The last days of May begin with a long weekend in the US followed by end-of-month flows. The events that stand out are the second estimate of US GDP for Q1 2018 and they re expected to confirm the 2.3% annualized growth rate. The Fed’s favorite inflation measure, the Core PCE, may tick up to 2%. The Non-Farm Payrolls report on Friday comes with few hints: only the ADP NFP will be of interest.

The jobs report is expected to show a reversion to the mean, close to 200K jobs. Wages which remain of high importance carry expectations for an increase of 0.3% m/m and a return to 2.7% y/y.

In Japan, Bank of Japan Governor Haruhiko Kuroda will speak on Wednesday at 00:00 and this is the key event for the week in Japan. Given the low levels of inflation, the BOJ will continue with its loose monetary policy for the foreseeable future.

Apart from the planned events, anything related to trade and North Korea will likely have a significant impact on the pair. US yields are slightly off the radar now, but they may return to the forefront.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

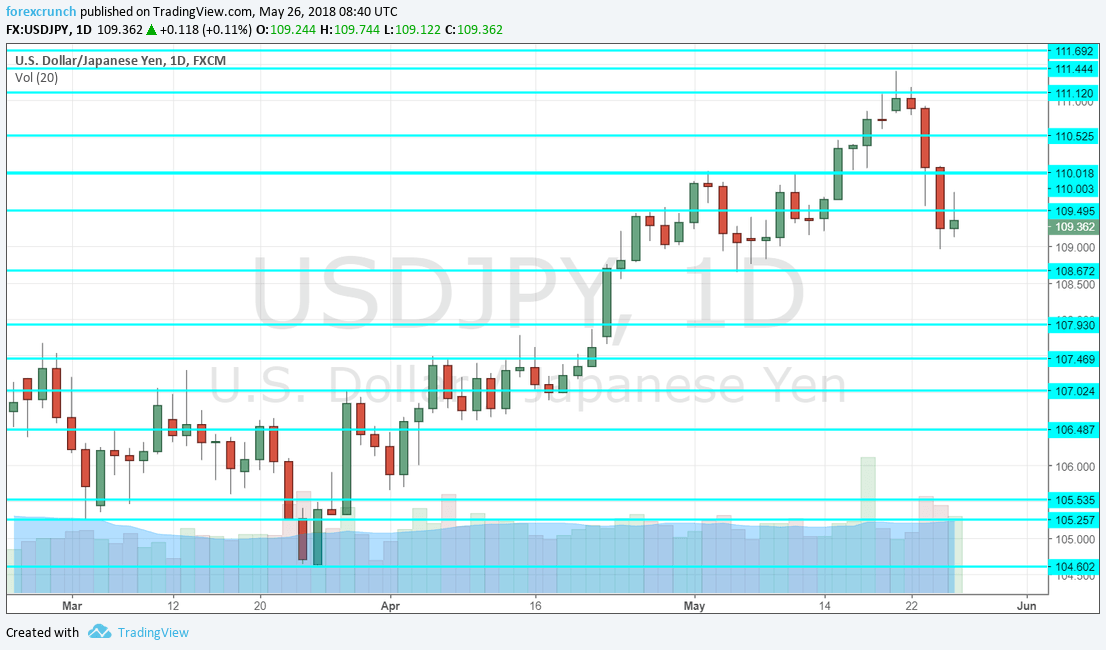

112.20 supported the pair back in December. It is followed by 111.40 which capped the pair in mid-May

Further down, 110.50 was a swing high in February. The round number of 110 serves as a psychological level. 109.50 held the pair back in late April.

109 was a pivotal line within the range. 108.70 was a stepping stone on the way up.

Lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The nasty surprise from the peace process in the Korean peninsula may be a minor issue in comparison to the rising hostility of the Trump Administration to trade. The risk-off mood may suffer and the pair could continue falling.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!