- All eyes are now on the US inflation report after last week’s strong jobs data.

- Headline US inflation in March is expected to be 5.2% year over year.

- The Fed will likely increase rates by 25 basis points next month by approximately 74%.

Today’s USD/JPY price analysis is slightly bullish. The US dollar pulled back on Wednesday before a keenly anticipated inflation report later in the day. The report might provide hints about the trajectory of Federal Reserve interest rate hikes.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

USD/JPY fell slightly but was close to Monday’s one-month high of 133.87 yen. This highlights the sharp differences between the aggressive tightening cycle of the Fed’s monetary policy and the ultra-loose policy of the Bank of Japan (BOJ).

After last week’s strong US jobs data, all eyes are now trained on the inflation report, with currency movements being muted before the report’s release.

According to a Reuters poll of experts, headline inflation in March is expected to be 5.2% year over year, down from 6.0% in February. However, core inflation is estimated to have increased slightly to 5.6%.

Tuesday’s Fed speakers gave little indication of how far interest rates might rise in the United States. New York Fed President John Williams stated that the direction of the central bank’s policy would rely on new data.

According to Patrick Harker, president of the Philadelphia Fed Bank, the rate hiking cycle might soon end.

The Fed will likely increase rates by 25bps next month by approximately 74%. Still, many rate decreases are also anticipated, starting as early as July and continuing until the end of the year.

USD/JPY key events today

Investors will focus on key economic releases from the US, including the inflation report and the FOMC meeting minutes. These will give clues on the Fed’s next policy move.

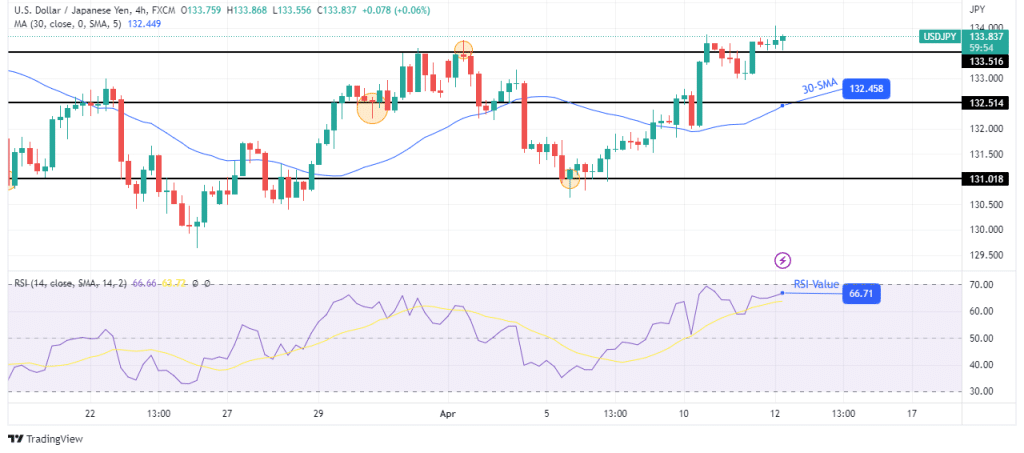

USD/JPY technical price analysis: Stuck around key resistance

The 4-hour chart shows USD/JPY in a bullish move slightly above the 133.51 resistance level. The price is well above the 30-SMA, while the RSI is close to the overbought region, showing solid bullish momentum.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

The price currently sticks to the 133.51 key level and can only break above when bulls push far above it. Therefore, there is still a chance that bears will return to push the price lower and retest the 132.51 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money