- Robust US consumer price data renewed the possibility of the Fed raising interest rates further.

- The yen retreated toward the critical 150 level, leading to speculation about currency market intervention.

- There was a slight increase in Japanese households’ price expectations.

The dollar fell slightly following its most significant daily gain since March the day before, making the USD/JPY price analysis slightly bearish. This decline came as robust US consumer price data renewed the possibility of the Fed raising interest rates further.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Notably, the September consumer price index (CPI) showed a 0.4% increase. It maintained the annual rate at 3.7%, similar to August. Meanwhile, economists had predicted a 0.3% monthly gain and a 3.6% year-on-year increase in CPI. Nicholas Van Ness, a US economist at Credit Agricole CIB, commented that this data would keep the Federal Reserve on its toes.

Additionally, Van Ness noted, “The primary scenario still involves an extended pause into 2024. Still, the possibility of a rate hike in December (or later) remains. This is especially if we see further positive surprises in forthcoming CPI and employment reports.”

The previous day’s strengthening of the US dollar prompted the yen to retreat toward the critical 150-level briefly touched the previous week. Consequently, there was increased speculation about currency market intervention.

Elsewhere, a quarterly central bank survey on Friday indicated a slight increase in Japanese households’ price expectations. This increase was in the three months leading up to September. It underscores the financial strain households are experiencing due to the elevated living costs. The Bank of Japan (BOJ) will closely examine this survey when creating new inflation forecasts during its October 30-31 policy review.

USD/JPY key events today

Neither the US nor Japan will release major economic reports today.

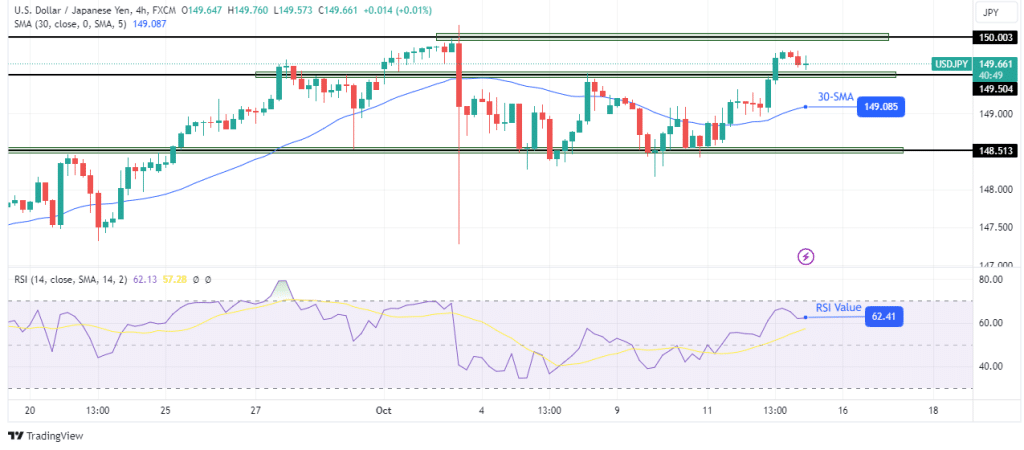

USD/JPY technical price analysis: Price retreats after overcoming 149.50 resistance.

The USD/JPY price is retreating after a recent surge that broke the price above the 149.50 resistance level. Nevertheless, bulls have a strong hold on the market as the price trades well above the 30-SMA, showing a steep move.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Moreover, the break above the 149.50 level made the price higher, with the RSI trading closer to the overbought region. With such a strong bullish bias, the retreat might only be temporary before bulls retest the 150.00 key resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.