- As USD/JPY falls to a two-month low for the fifth day in a row, it continues to lose positions.

- JPY is supported and under pressure due to the tightening of the US-Japan yield spread and cautious sentiment.

- For now, the pair is supported by a modest rise in the US dollar from its lowest level since July 5.

Despite falling to a two-month low on Tuesday, the USD/JPY price continues to drop for a fifth straight day. At the start of the European session, spot prices bounced back from the daily lows and pulled back towards 131.00.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

In spite of the BoJ’s more dovish stance, global yields have dropped recently, making the Japanese yen more attractive. Federal Reserve officials hinted last week that their rate hike campaign may eventually slow down.

The US GDP report released last Thursday confirmed a technical recession, fueling speculation the Fed won’t raise rates as aggressively as expected. In the last month, the benchmark 10-year Treasury note yield has fallen to its lowest level since April. Japanese government bond yields remain flat due to the Bank of Japan’s yield curve control policy.

Furthermore, some safe-haven flows drive USD/JPY downward due to the generally soft risk tone. Market sentiment remains fragile despite growing concerns about a global economic slowdown.

Additionally, investors’ appetite for risky assets is reduced by Nancy Pelosi’s likely trip to Taiwan. In spite of this, the US dollar’s modest recovery from its lowest level since July 5 provides some support for the major currency. Any serious recovery attempt, however, would likely fail fairly quickly based on the fundamentals.

With US JOLTS job offers expected to be published soon, this will affect US dollar price momentum and help lift USD/JPY. Market risk appetite will also guide traders to take advantage of near-term opportunities, although the focus will be on Friday’s US non-farm payrolls report.

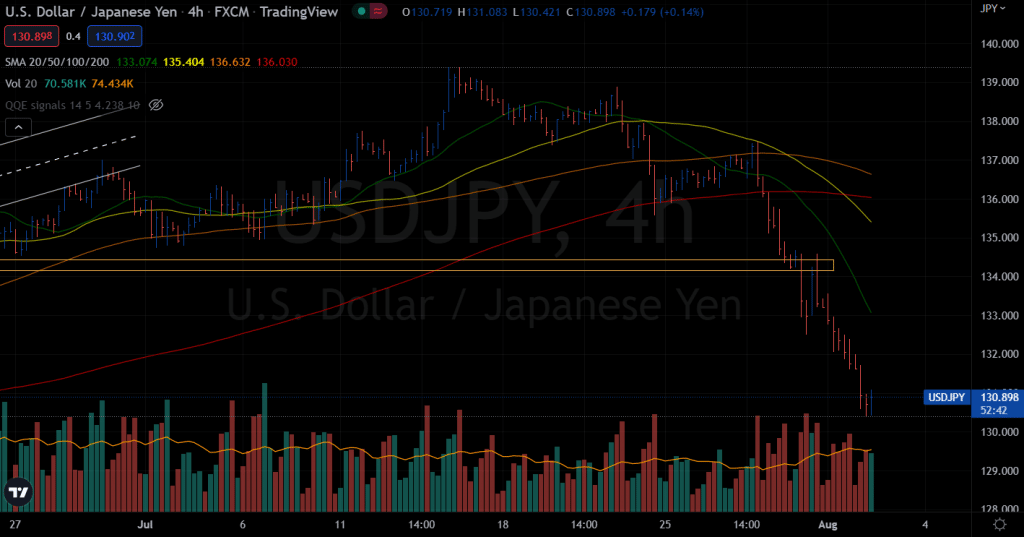

USD/JPY price technical analysis: Consolidating losses around 131.00

The USD/JPY price remains well below the 20-period SMA on the 4-hour chart. It indicates a strong bearish bias. If we examine the demand zone breakout at 134.00, we can clearly see a strong bearish wave.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Although the price slightly gained, the pair still sees no sign of meaningful recovery. We may see some consolidation around 131.00 before resuming the downtrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.