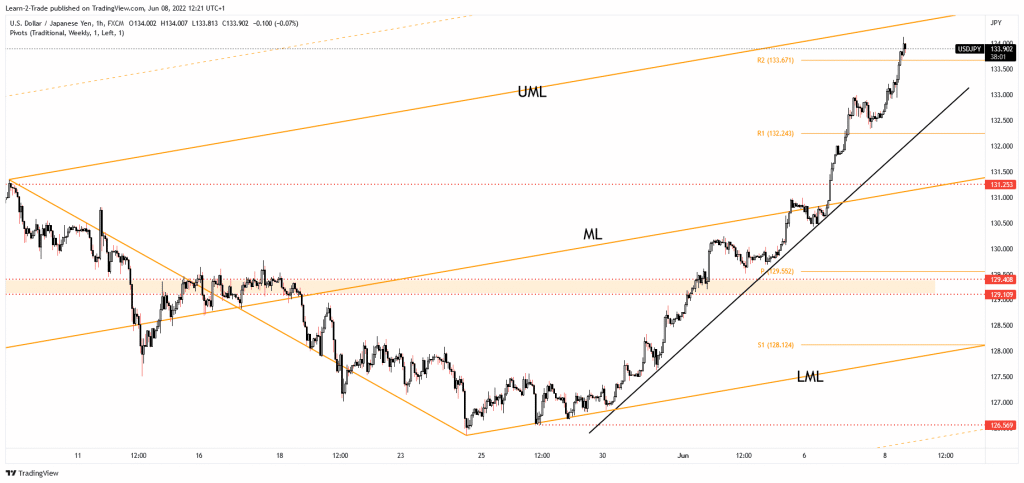

- The USD/JPY pair maintains a bullish bias as long as it stays above the R2.

- The upper median line (UML) represents the near-term target.

- After its strong rally, we cannot exclude a temporary correction.

The USD/JPY price registered an amazing growth as the Japanese Yen was weakened while the DXY’s rebound lifted the USD. The Yen Futures dropped by 5.85% since 24 May 2022. The currency pair was trading at 133.95 at the time of writing, and it maintains a bullish bias. The USD/JPY pair climbed as high as 134.29 today, where it found a weak resistance.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

Fundamentally, the Japanese economic data came in mixed today. The Economic Watchers’ Sentiment was reported at 54.0 points versus 51.9 expected compared to 50.4 in the previous reporting period. Final GDP registered a 0.1% drop versus a 0.3% drop estimated, while the Final GDP Price Index dropped by 0.5% more versus the 0.4% fall forecasted.

In addition, the Current Account came in at 0.51T above 0.40T expected, while the Bank Lending rose by 0.7% even if the specialists expected a 0.8% growth. Later, the US Final Wholesale Inventories could report a 2.1% growth.

The ECB could also bring strong action on the USD/JPY pair tomorrow. Still, only the US inflation data could change the sentiment. The CPI is expected to report a 0.7% growth in May, while the Core CPI could register a 0.5% growth.

USD/JPY price technical analysis: Bullish trend

The USD/JPY pair extended its growth, and now it challenges the 134.00 psychological level. Its failure to retest the uptrend line signaled strong buyers and an upside continuation. It has ignored the weekly R2 (133.67), representing a static upside obstacle. Stabilizing above it may signal more gains.

-Are you interested in learning about the forex indicators? Click here for details-

The ascending pitchfork’s upper median line (UML) represents a potential target, a dynamic resistance. A minor retreat or a strong consolidation could bring new long opportunities.

Still, the rate could develop a corrective phase after the current swing is higher. Though, as long as we don’t have a bearish signal, it’s premature to talk about a sell-off.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money