- The USD/JPY pair seems determined to hit new lows.

- The FOMC and the NFP could be decisive.

- After its leg is higher, the sell-off is natural.

The USD/JPY price slipped as the US dollar dropped in the last hours. The pair is trading at 147.66 at the time of writing and seems to be under pressure after failing to hit the 149.00 psychological level.

-Are you looking for automated trading? Check our detailed guide-

Fundamentally, the USD lost ground versus its rivals after the US Chicago PMI dropped unexpectedly from 45.7 to 45.2. The traders expected a potential growth of 47.8 points.

On the other hand, the Japanese economic data came in mixed yesterday. Retail Sales reported a 4.5% growth exceeding the 4.0% growth expected, while Prelim Industrial Production, Housing Starts, and Consumer Confidence came in worse than expected.

Today, the Japanese Final Manufacturing PMI came in at 50.7 points, matching expectations. Later, the US is to release high-impact data. ISM Manufacturing PMI could drop from 50.9 to 50.0 points, while JOLTS Job Openings are expected at 9.75M compared to 10.5M in the previous reporting period.

In addition, Final Manufacturing PMI could remain steady at 49.0, Construction Spending may report a 0.5% drop, and ISM Manufacturing Prices could jump from 51.7 to 53.0 points. At the same time, Wards’ Total Vehicle Sales are expected to be 14.5M.

Key events today

Tomorrow, the FOMC and the ADP Non-Farm Employment Change are high-impact events. The Federal Funds Rate is expected to be increased from 3.25% to 4.00%.

Also, don’t forget that the US NFP, Unemployment Rate, and Average Hourly Earnings could also be decisive.

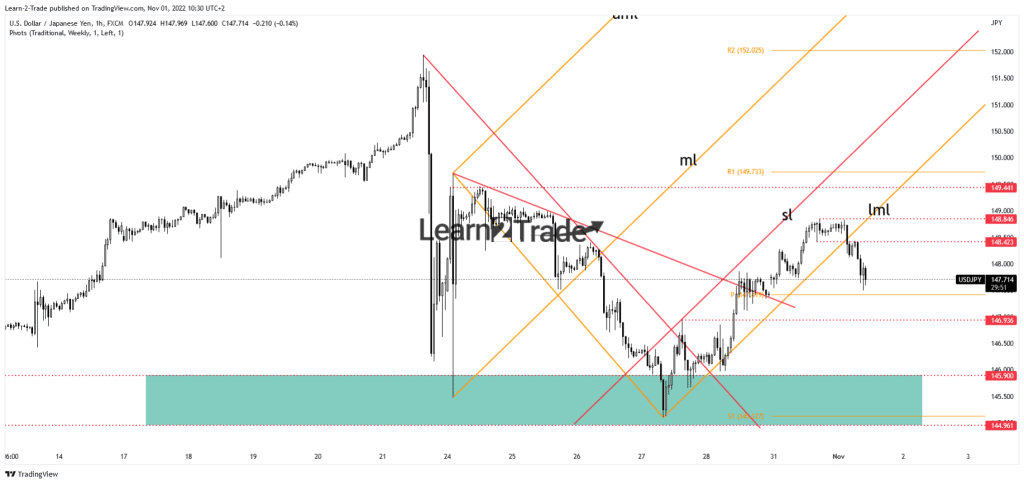

USD/JPY price technical analysis: Buyers run out of steam

Technically, the price failed to take out the 148.84, signaling exhausted buyers. Breaking below the lower median line (LML) and making a new lower low activated more declines. Now, it challenges the weekly pivot point of 147.41.

-If you are interested in forex day trading then have a read of our guide to getting started-

Taking out this static obstacle may announce more declines, at least towards 146.93. The 145.90 – 144.96 zone represents a major downside target. Still, it remains to see how it will react after the current massive drop. In the short term, it could move sideways between 149.44 and 145.90.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.