- The BOJ surprised the markets by adjusting its yield control.

- Japan’s core consumer inflation reached a new four-decade high.

- Japan’s core consumer price index (CPI) increased by 3.7% from a year earlier in November.

The USD/JPY weekly forecast is bearish as investors expect more changes from the BoJ in 2023. However, the market may correct higher in the short-term.

Ups and downs of USD/JPY

The yen had a strong week, with the USD/JPY pair closing much lower. On Tuesday, the BOJ surprised the markets by adjusting its yield control and permitting long-term interest rates to climb more. Market participants saw this action as a precursor to a further withdrawal of the BOJ’s enormous stimulus program. This saw the yen gaining on the dollar.

–Are you interested to learn more about forex signals? Check our detailed guide-

Haruhiko Kuroda, the BOJ governor, whose term will end in April, said that the bank had no intention of reducing stimulus because inflation was predicted to drop below 2% in 2023. However, the October minutes revealed how many of his fellow board members are now focusing on the possibility of a stimulus withdrawal and the risk of an inflation overshoot.

Data revealed that Japan’s core consumer inflation reached a new four-decade high as businesses continued to pass on rising costs to households. This was a sign that price increases were becoming more widespread and that the central bank might continue to face pressure to reduce its massive stimulus program.

According to figures released on Friday, the core consumer price index (CPI) for Japan, which includes energy costs but excludes volatile fresh food prices, increased by 3.7% from a year earlier in November, in line with market expectations and accelerating from a 3.6% increase in October.

Next week’s key events for USD/JPY

There won’t be any significant events next week as markets will be closed for Christmas.

USD/JPY weekly technical forecast: Bullish RSI divergence

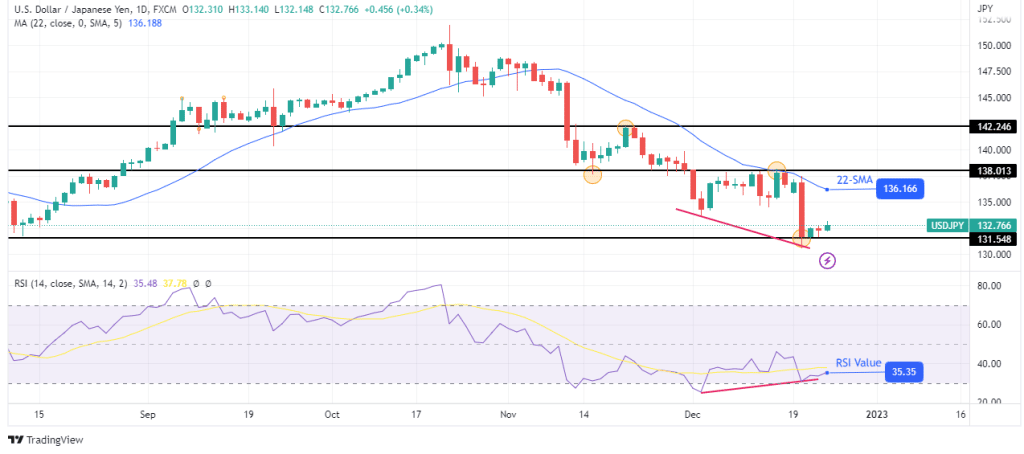

The daily USD/JPY chart shows the price trading far below the 22-SMA and the RSI below 50. This shows that the current trend is bearish. The price could not go below the 131.54 support level, where it paused.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

A closer look at the RSI shows a bullish divergence with the price. This divergence shows weakness in the bears as they are losing momentum. It might allow for a retest and possible break above the 22-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.