- At the meeting of the FOMC on March 16th, Powell confirmed a hike of 0.25%.

- WTI rose to $114.58 and Brent to $115.65 due to the war in Ukraine.

- Japan’s safety attracts investors, offsetting the US dollar.

The weekly forecast for the USD/JPY pair is neutral as both the USD and JPY are safe-haven assets that found a rise in demand after the Ukraine conflict.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

A bearish reaction to the invasion of Ukraine was seen in USD/JPY. From February 28th to March 4th, the opening and closing ranges were 115.67 and 114.70, respectively. However, despite the provocation, it is quiet versus EURUSD, with prices fluctuating between 114.41 and 115.80.

It might be more accurate to say the USD/JPY reacted dovish to the war. As with the USD/CHF (Swiss Francs) pair, USD/JPY offers safe trading on both sides of the pair. The US dollar and US assets, especially government bonds, are the global choice in turbulent times. However, a US dollar is not the only safe harbor. Historically, Japan has been a haven for safety flows from Asian markets due to its advanced economy, sophisticated financial system, and social and political stability.

Despite notable volatility on Monday and Wednesday, the USD/JPY opened the week at 115.00 and traded lower on Friday morning at 114.69.

After the Russian attack on Ukraine, world crude oil prices rose by about 20%. Most of Japan’s energy is imported. The rapid increase in industrial costs would adversely affect the country’s economic prospects and the yen since the US is much closer to energy self-sufficiency than Japan. Remarkably, no reaction has been observed.

Economic data for Japan passed. In February, consumer sentiment fell to 35.3 from 36.7, the lowest since May last year. However, despite the six-month low, the Jibun Bank Manufacturing Purchasing Managers Index (PMI) in February was 52.7, slightly below January’s reading of 52,9.

Jerome Powell’s two-day testimony in Congress was more relevant than the US statistics. At the Fed’s March 16th meeting, Powell confirmed the plan to begin an inflation campaign with a 0.25% hike. Many legislators asked about the economic risks associated with Ukraine and how a sharp rise in oil prices would impact inflation. There have already been political concessions as a result of the Ukraine issue. The markets had anticipated an increase of 0.5% on March 16th, two weeks ago.

Except for employment, the purchasing managers’ indices for manufacturing and services were better than expected in February. However, the services employment index fell to 48.5, marking the first time it has fallen below the 50 mark since July.

The nonfarm payrolls were 678,000 in February, well above the consensus estimate of 400,000. In addition, there were 215,000 initial claims for unemployment benefits in the last week of February.

Markets continue to be dominated by the war in Ukraine. As a result, conflict-related safety filters apply to Fed policy, the US job market, and even skyrocketing oil prices.

Commodities’ price increases may be hurting the Japanese economy more than the US economy. Securities trading will dominate USD/JPY as fighting in Ukraine persists, leading to fears of a wider European conflagration.

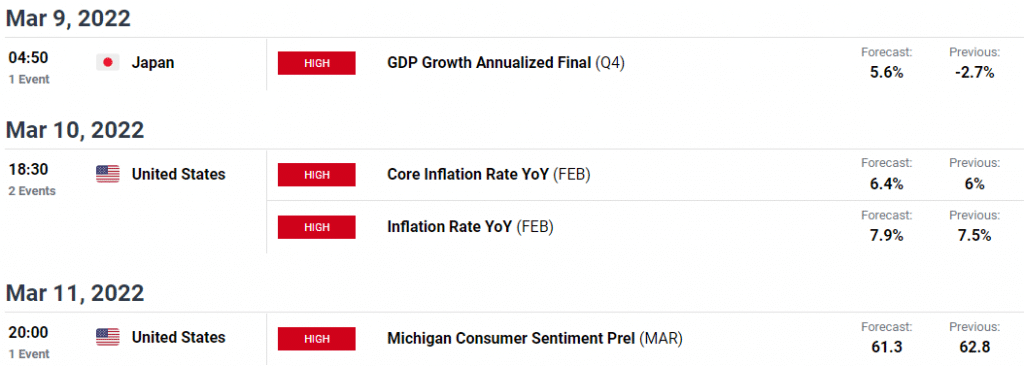

Key data/events for USD/JPY

After the revision, Japan’s GDP is expected to rise to 5.6% y/y. Both the Business Survey Index (BSI) for the first quarter and Eco Watchers for February will provide a snapshot of current economic conditions in Japan.

The US consumer price index is the main story this month. With interest and policy rates expected to rise, the impact of the Fed’s immediate policy will be evident in the outlook for the economy and federal funds to be presented at the March 16th meeting.

Despite the ongoing conflict in Ukraine and a lack of progress in talks, Treasury rates fell sharply along the yield curve on Friday.

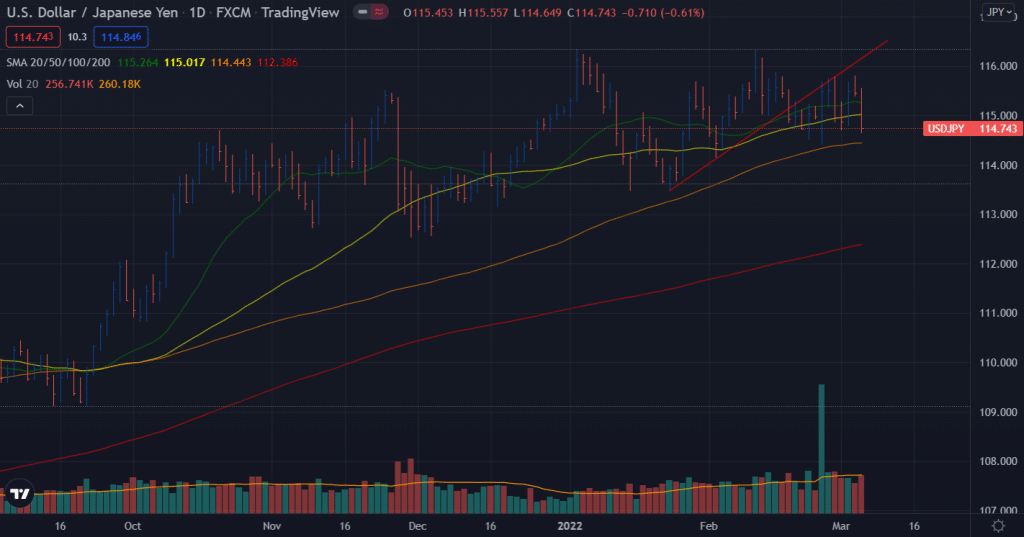

USD/JPY weekly technical forecast: Bulls vs. bear to continue

The USD/JPY daily price chart shows a strong bullish bar with a huge volume rejected by an ascending (broken) trendline. After then, you can see a phase of consolidation and then a bearish breakout bar with a huge volume, closing below the 20-day and 50-day SMAs. Now the pair’s immediate support is at the bullish bar’s low and the 10-day SMA at 114.35 ahead of 114.00.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

On the upside, the pair may find a relief rally towards 115.00 ahead of 115.50. Meanwhile, the probability of testing the multi-month swing highs at the 116.40 area remains high amid the firm US dollar.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money