- The dollar weakened amid bets of a Fed pause in June.

- The activity level in the US services sector came in lower than expected.

- The Fed will likely keep rates unchanged next week.

The USD/JPY weekly forecast is bearish as investors expect a pause in the Fed’s rate hike cycle amid a rise in unemployment.

Ups and downs of USD/JPY

USD/JPY has had a slightly bearish week, with the dollar weakening amid bets of a Fed pause in June. The move came after data supported expectations that the Fed would maintain its current rates next week.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Surprisingly, PMI data showed reduced business activity in the US non-manufacturing sector. Moreover, the activity level in the services sector came in lower than expected.

However, the biggest catalyst was the jobless claims report. The report revealed a significant surge in unemployment claims in the US, pointing to weakness in the US labor market.

CaxtonFX strategist David Stritch stated that this surge brought jobless claims near a two-year peak. Markets interpreted it as a definite indication of impending economic weakness in the US and a Federal Reserve that is more cautious about raising rates.

Next week’s key events for USD/JPY

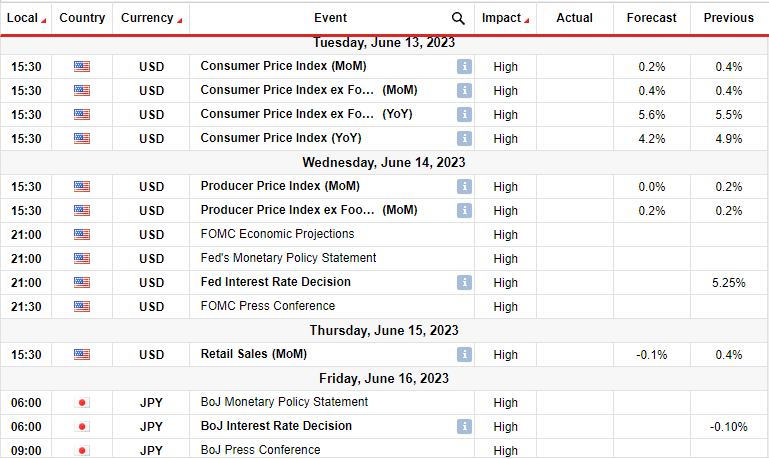

Next week is packed with key economic releases from the US and Japan. The US will release inflation data before the FOMC meeting and close the week with the retail sales report on Thursday. On the other hand, Japan will have the BOJ policy meeting, which investors are also eagerly awaiting.

At the end of its June 13-14 meeting, the Fed will likely keep rates unchanged. However, the Fed will probably adopt a hawkish stance and signal the likelihood of a rate hike in July due to inflation persisting above its 2% objective.

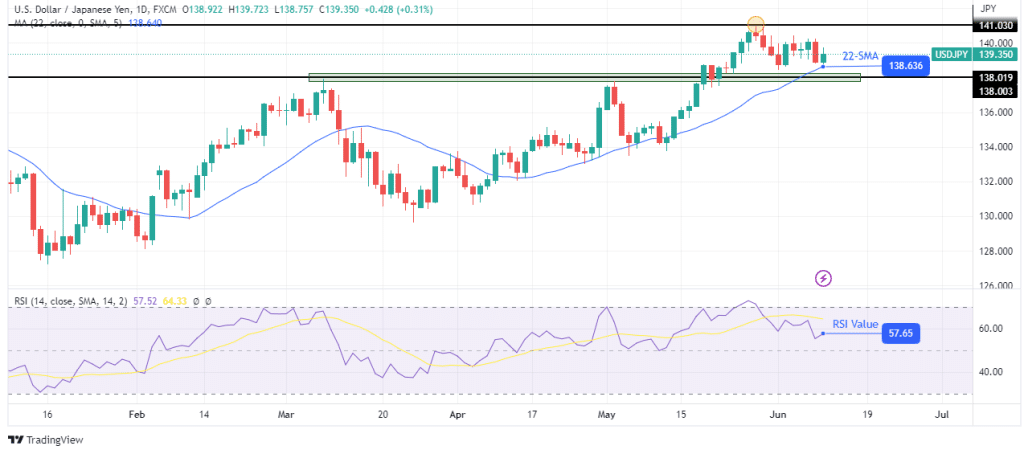

USD/JPY weekly technical forecast: Bulls look to the next resistance at 141.03.

USD/JPY is in a strong bullish trend that has seen the price increase and lower. The price has also respected the 22-SMA as support, bouncing higher every time it retested the level. Moreover, the RSI supports strong bullish momentum as it sits above the 50-level.

–Are you interested to learn more about automated trading? Check our detailed guide-

The price has retreated from recent highs to retest the 22-SMA resistance. If the 22-SMA support holds as it has done before, the price will likely rise to retest the 141.03 resistance level. A break above this resistance would allow the price to make new highs and continue the bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.