The Bank of Canada raised rates and also let us know it’s not a one-off move. Dollar/CAD dropped from above 1.29 to 1.2820 but did not stop there.

The Canadian dollar tends to move slowly, providing opportunities for traders to jump on the waggon. We are seeing another example of this today.

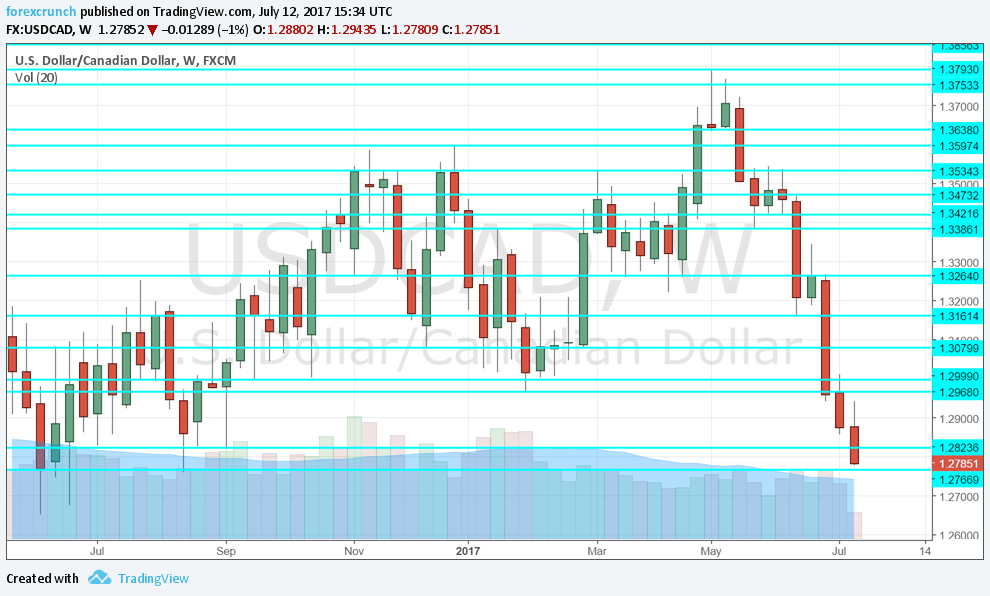

At the time of writing, USD/CAD has reached a low of 1.2778, approaching the low point of 1.2760 seen back in August 2016. Another push, and we are at the lowest levels since June of last year.

Update: the falls extend to 1.2760. This is already a new 13-month low.

The background is the accompanying press conference by Governor Stephen Poloz. The statement contained a phrase about inflation being higher without temporary factors. Poloz puts a number on it: 1.8% without those factors.

He went further to suggest that inflation will even overshoot in 2019. These are tunes that are not heard at the FED, ECB nor the BOJ. What the BOC does have in common with the US Federal Reserve is being “data dependent”. The next moves depend on evolving inflation.

Here is how the move looks on the weekly chart. Further support below 1.2760 is at 1.2645.