The Canadian dollar rebounded last week, gaining 150 points. USD/CAD closed the week at 1.3150. This week’s key event is GDP. Here is an outlook on the major market- movers and an updated technical analysis for USD/CAD.

As expected, US GDP softened in Q4 compared to the previous quarter. The economy expanded 1.9%, close to the estimate of 2.1%. Unemployment Claims and Existing Home Sales both missed expectations, but consumer confidence moved slightly higher, beating the forecast. In Canada, there was just one release, with Wholesale Sales dropping to 0.2%, within expectations.

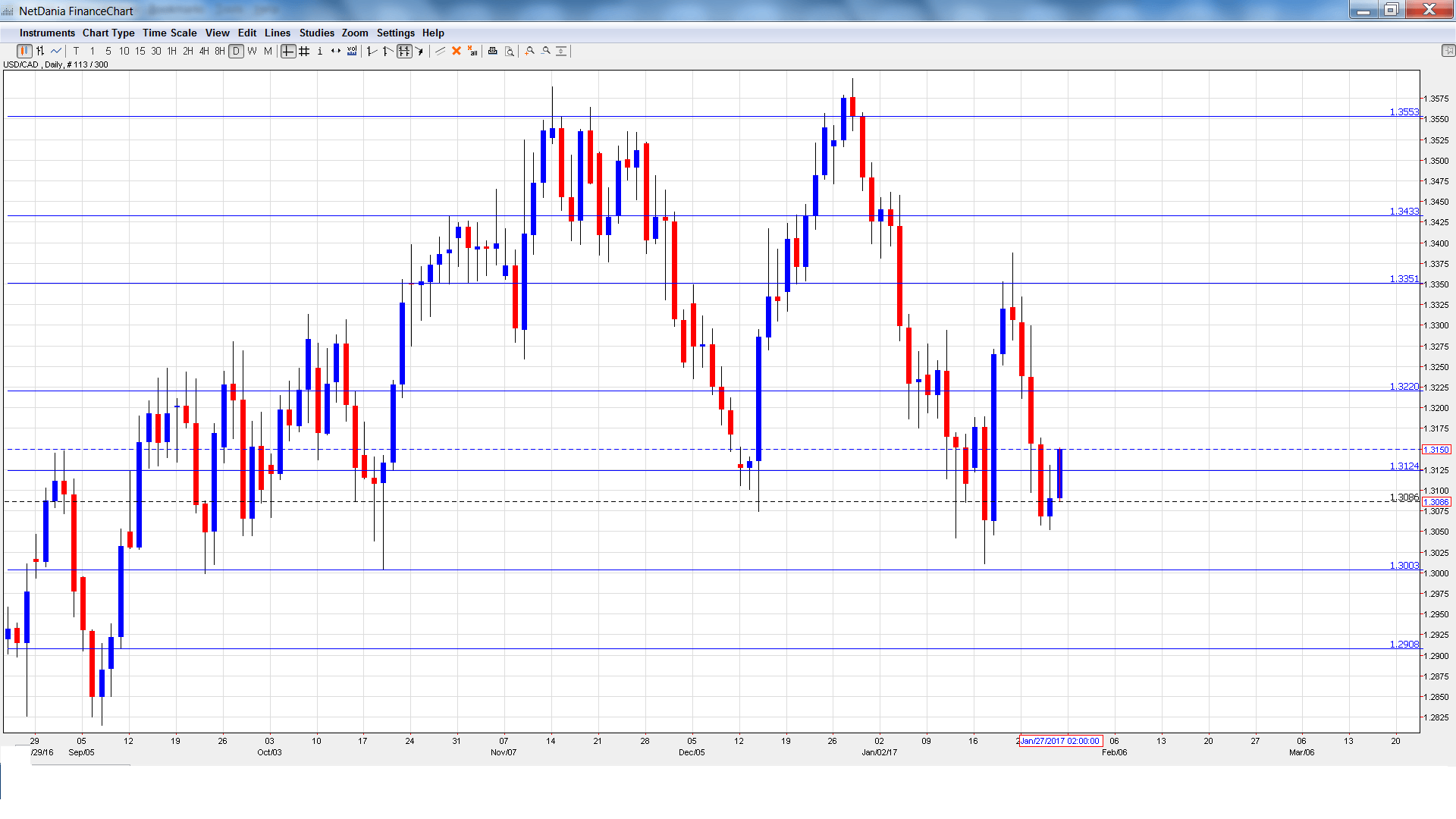

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Tuesday, 13:30. Canada releases GDP reports each month and the indicator should be treated as a market-mover. The economy contracted 0.3% in October, short of the estimate of +0.1%. This marked the first decline in five months. The markets are expecting a rebound in November, with an estimate of +0.3%.

- RMPI: Tuesday, 13:30. This indicator measures inflation in the manufacturing sector. The index has struggled, recording just one gain in the past five months. Will we see a gain in the December release?

- BoC Governor Stephen Poloz Speech: Tuesday, 22:35. Poloz will speak at an event in Edmonton. Analysts will be looking for clues regarding the BoE’s future monetary policy.

- RBC Manufacturing PMI: Wednesday, 14:30. The PMI is pointing to weak expansion in the manufacturing sector, with a reading of 51.8 in December. Little change is expected in the January report.

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3303 and quickly touched a high of 1.3334, as resistance held at 1.3351 (discussed last week). The pair then reversed directions as the pair dropped to a low of 1.3052. USD/CAD pushed higher late in the week and closed at 1.3150.

Live chart of USD/CAD:

Technical lines, from top to bottom

We start with resistance at 1.3551.

1.3433 was the high point in October.

1.3351 was tested in resistance for a second straight week.

1.3219 is next.

1.3124 is a weak support level.

1.3003 is protecting the symbolic 1.30 level.

1.2908 has held in support since September 2016.

1.2763 is the final support line for now.

I am bullish on USD/CAD

Just a week into his new job, Donald Trump has not shied away from controversy. The new president withdrew the US from the Trans-Pacific Partnership and has escalated tensions with Mexico. However, the economy is strong and if inflation levels move higher, we could see the Fed step in with additional rate hikes which is bullish for the US dollar.

Our latest podcast is titled Trumping Trade and the Donald Dollar

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.