USD/CAD reversed directions last week, and climbed over 100 points. The pair closed at 1.3039. This week’s key event is the Overnight Rate and Manufacturing Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, the Fed minutes were cautious and a rate hike remains unlikely. US employment numbers were strong, in contrast to Canadian employment numbers, as USD/CAD climbed back above the 1.30 level.

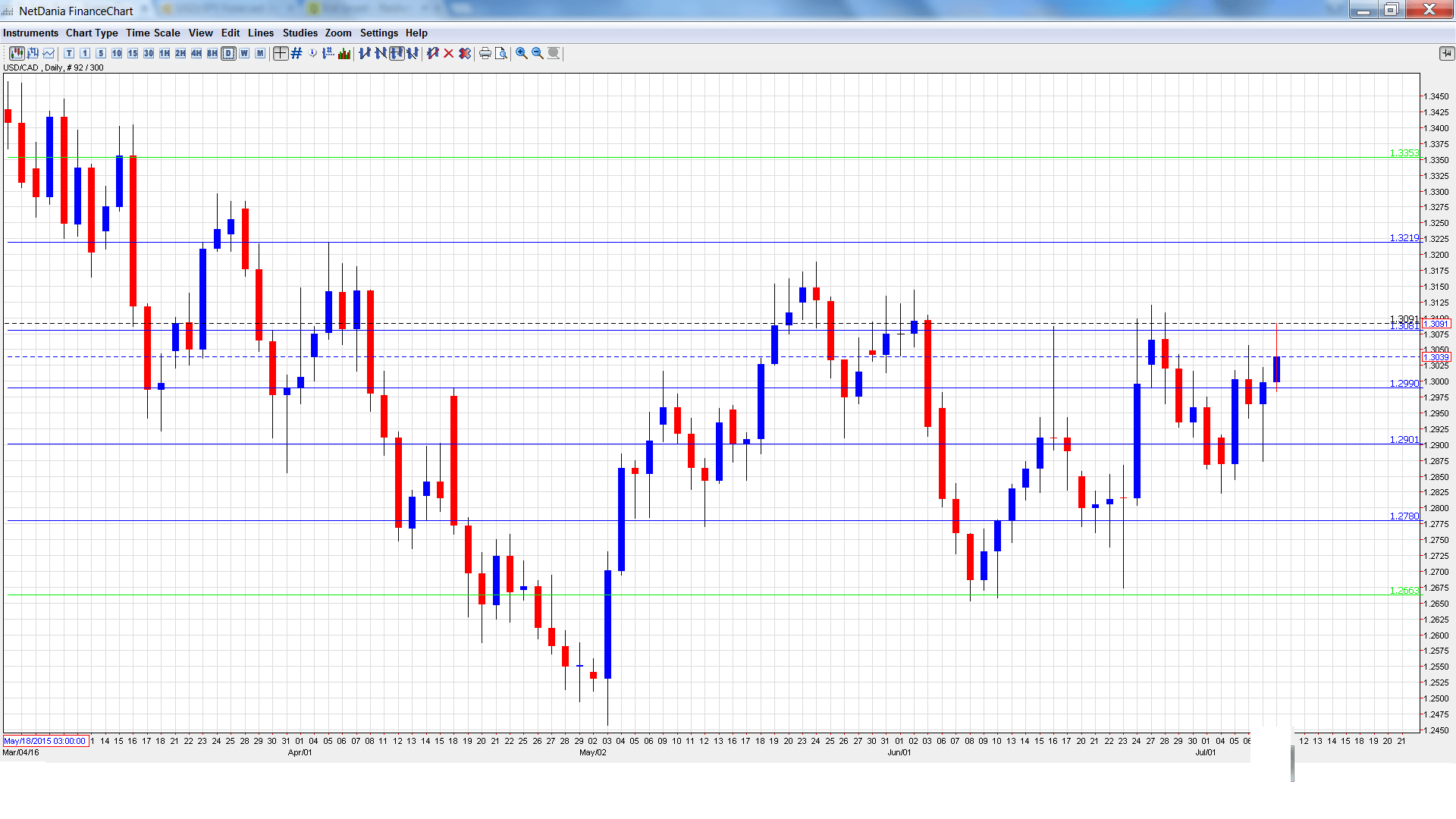

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Monday, 12:15. Housing Starts provides a snapshot of the level of activity in the housing sector. The indicator has been on a downtrend and dropped to 189 thousand, within expectations. The estimate for the May report stands at 192 thousand.

- BOC Monetary Policy Report: Wednesday, 14:00. This report is released quarterly and provides the BOC’s views on the economy and inflation. A press conference will follow.

- BOC Overnight Rate: Wednesday, 14:00. The central bank has pegged the benchmark rate at 0.50% since July 2015, and no change is expected in the upcoming rate announcement.

- NHPI: Thursday, 12:30. This housing inflation index has been steady and edged up to 0.3% in the April report. The estimate for the May release stands at 0.2%.

- Manufacturing Sales: Friday, 12:30. This key indicator rebounded in April and posted a strong gain of 1.0%, beating the estimate of 0.7%. Will the indicator post another solid gain in the May report?

USD/CAD opened the week at 1.2910 and quickly touched a low of 1.2823. The pair then reversed directions and climbed to a high of 1.3091, testing resistance at 1.3081(discussed last week). USD/CAD closed the week at 1.3039.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We start with resistance at 1.3353

1.3219 was a cap in April.

1.3081 was tested for a second straight week as USD/CAD climbed close to the 1.31 level.

1.2990 is next.

1.2900 has switched to a support role following gains by USD/CAD.

1.2780 is a strong support line.

1.2663 has held firm in support since early May. It is the final support line for now.

I am bearish on USD/CAD

The Fed remains cautious about the US economy and is unlikely to raise rates anytime soon. This could hurt the Canadian dollar, as the Canadian economy is heavily reliant on the US. As well, Brexit jitters could keep investors away from risk currencies like the Canadian dollar.

Our latest podcast is titled 3 markets – 3 totally different Brexit reactions

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.