The Canadian dollar is sliding down together with oil prices. In relatively subdued markets, the move in the C$ stands out. The move owes many thanks to the price of the black gold.

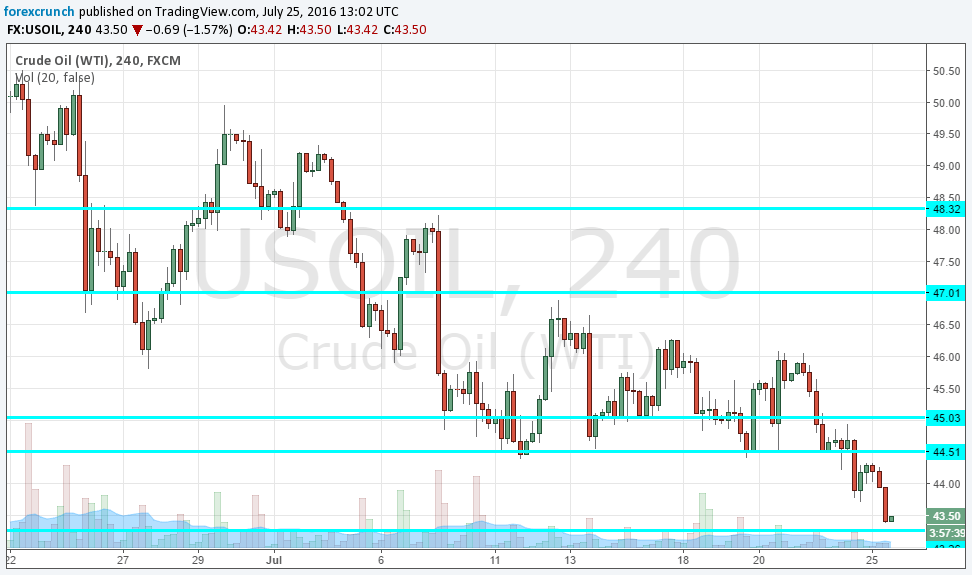

WTI Crude Oil is slipping to the lowest level since May, gradually reversing the rise seen in the past two months. Rising production in the US is seen both via the weekly inventories report as well as the rig count. Production issues in Nigeria or Lybia are no longer big news. On the demand side, the driving season may not be as huge as had been anticipated.

All in all, we saw a slip to as low as $43.39. The most recent slip is not a terrible disaster, but just a continuation. Nevertheless, this is some 9 dollars from the peak. Here is the chart:

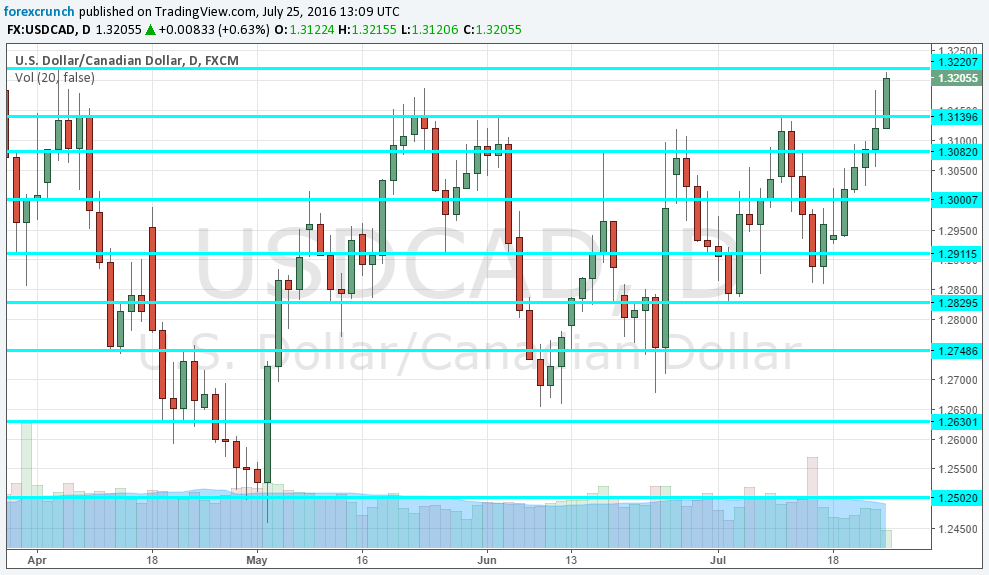

The Canadian dollar does not like it anymore. The loonie managed to survive quite nicely so far, showing a lot of resilience. But now it is beginning to crack.

Dollar/CAD reached 1.3215 and clings onto 1.32. These are the highest levels since April. Resistance awaits at 1.3220, followed by 1.3310. Support is at 1.3140 and 1.3080.

More: Elliott Wave Analysis: Corrective Bounce within Downtrend on USDCAD