Dollar/yen dipped had a strong start to the week but petered out later on. The pair has been sliding as enthusiasm from the Fed’s hawkishness was replaced by skepticism. The chart shows lower highs and lower lows.

This is a new format of the outlook and feedback is welcome. We cover the top fundamental news and outlook, a technical analysis on the daily chart and finally sentiment for the pair moving forward.

USD/JPY fundamental movers

The US dollar extended the trend early on, thanks to very optimistic comments from Bill Dudley. The No. 3 at the Fed continued Yellen’s line of being bullish on growth and employment while dismissing low inflation.

However, other members such as Bullard, Harker, and Evans all expressed worries about disinflation, including the effect from Amazon’s purchase of Whole Foods. This weighed on the greenback.

The upcoming week begins with a strong start from durable goods orders, continues with the CB consumer confidence and culminates with the final read of US GDP. It is also important to watch out for the Core PCE Price Index, the Fed’s favorite measure of inflation.

See all the main events in the Forex Weekly Outlook

In general, $/yen hardly moves on Japanese events. Japan’s trade surplus came out slightly lower than expected.

The upcoming week features Japanese inflation figures on Thursday at 23:50. Watch out for the more up-to-date Tokyo CPI. The unemployment rate in Japan dropped to a low of 2.8%.

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

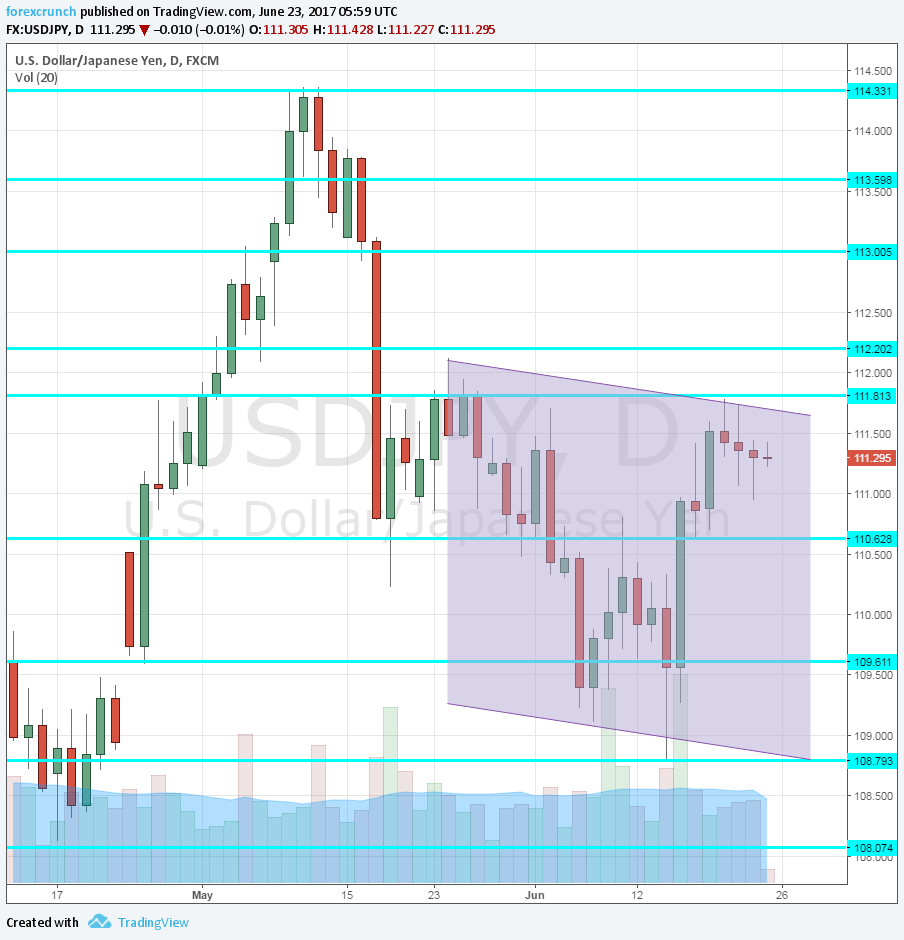

The current range for the pair is the wide area between a recent low of 110.60, seen in June, and a recent high of 111.80, a lower high on the chart.

Looking up, 112.20 is resistance after capping the pair in April and in May. It is followed by the round level of 113, which was a stepping stone on the way up. Further resistance is at 113.60 which served as resistance in the past.

The cycle high of 114.30 is a strong level of resistance, the highest since March. Further above, 115 and 115.35 are notable.

Looking down, 109.60 was a gap line in late April, a gap that was never closed. In June, the pair found support several times at 109.10 and this also works as support.

Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

Downtrend Channel

As the chart shows, the pair is experiencing lower highs and lower lows, forming a downtrend channel since the end of May. The lower highs are more significant than the lows.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The jump in the pair that was seen last week was eroded and so has the momentum. The pair is in the middle between the cycle high of 114.30 and cycle low of 108.10. The downtrend channel goes hand in hand with skepticism about the next move by the Fed. US GDP and the Core PCE could provide a reminder that the US economy is not going anywhere fast.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl