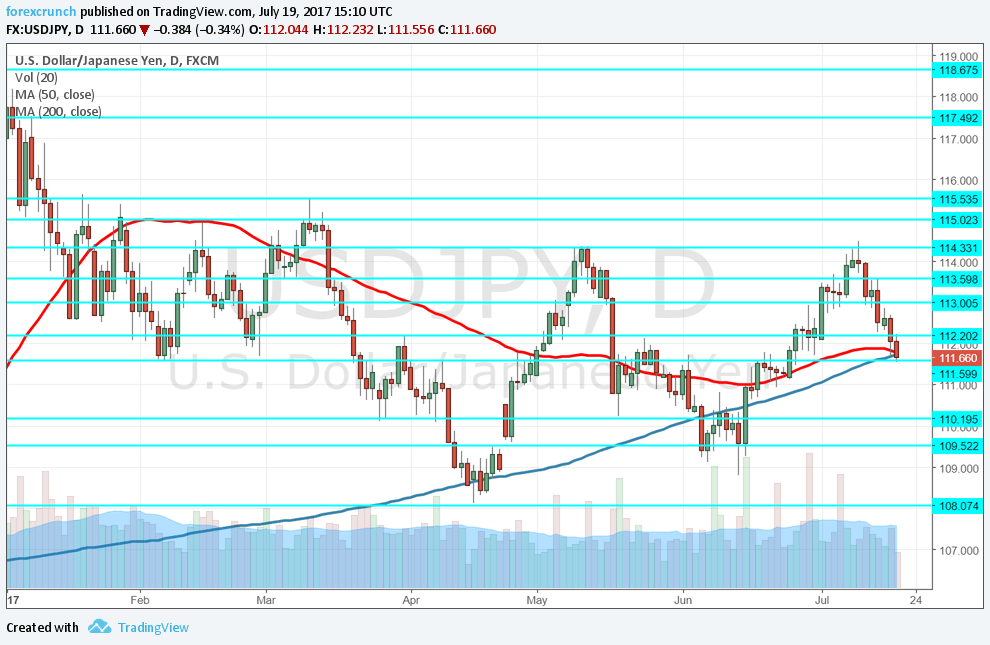

It may sound scary, but there could be a big opportunity. The last time it happened the pair dropped over 2000 pips in six months. Will it happen again? The team at SocGen explains:

Update That death cross proved decisive

Here is their view, courtesy of eFXnews:

Societe Generale FX Technical Strategy Research notes that USD/JPY charts point to a ‘death cross’, confirmed this morning as the 50-day USD/JPY moving average edges below the 200-day moving average.

“The last time this happened was in December 2015, when USD/JPY was above 122. By June 2017, it had broken below 100,” SocGen adds.

In the short term, SocGen expects the pair to extend south towards the head and shoulders targets at 111.20/111.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.