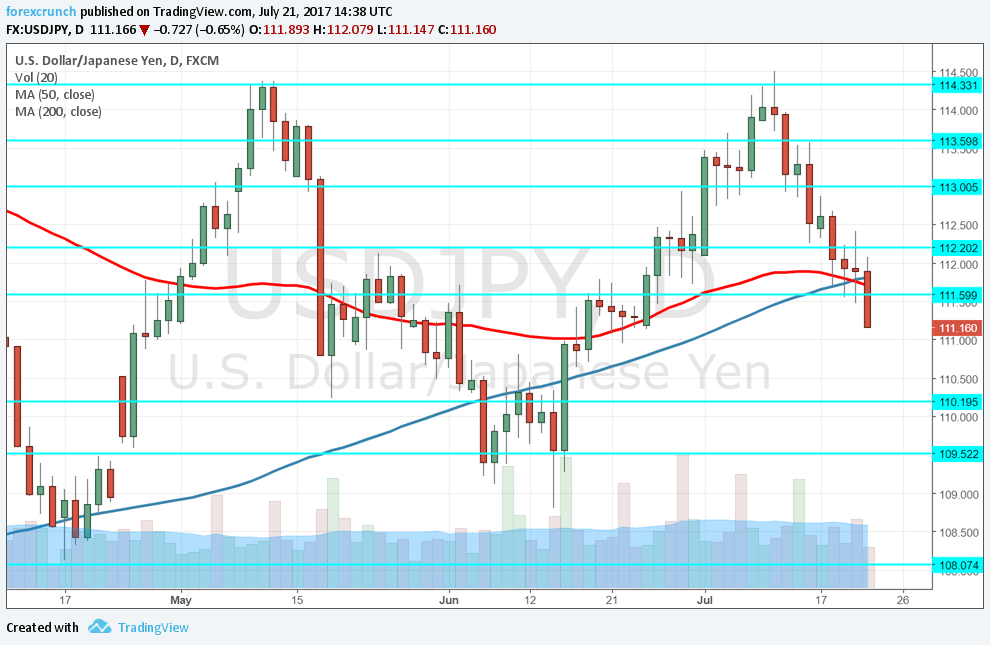

The technical pattern of a “death cross” on USD/JPY, noted back on Wednesday seems to be working. USD/JPY is diving deeper.

The 50 day moving average pierced through the 200 day moving average for the first time since December 2015. In that case, the result was a collapse worth over 2,000 pips.

Even if this technical pattern is not going to repeat its cast its full spell once again, there are reasons for this sell-off.

Why the dollar is falling

The fundamental driver is Donald Trump. The president is getting deeper into trouble as the special counsel dives deeper into his dealings. The pace of revelations is growing. Trump is frustrated that AG Sessions had to recuse himself and he reportedly wants to dig dirt against the team investigating him.

The US dollar had earlier dropped on the failure to pass the healthcare bill, but it may be only resting, not fully dead just yet. Moreover, the greenback is suffering not only because of the unwinding of the Trump trade but also on slow inflation.

USD/JPY levels to watch

The pair reversed more than half of the recent range, reaching 111.14, just under the halfway point between the cycle low of 108.10 and the cycle high of 114.50.

The immediate support line is 110.80. It is followed by 110 and then 108.80. Resistance awaits at 112.20.

This is the daily chart. Note that the cross that occurred very recently.

More: USD/JPY slipping off steep uptrend support – big downfall coming?