Dollar/yen drifted to the upside, as the Bank of Japan was left alone as the most dovish central bank. Has the downtrend channel been broken for good? We are still within the wider range: 108.10 to 114.30, but higher.

This is a new format of the outlook and feedback is welcome. We cover the top fundamental news and outlook, a technical analysis on the daily chart and finally sentiment for the pair moving forward.

USD/JPY fundamental movers

Central bankers and Trump care

The highly anticipated speech by Janet Yellen did not result in anything related to monetary policy. However, some of her colleagues expressed concerns about slowing inflation. This included Williams and Harker. Fischer, No. 2 at the Fed, and also Yellen, did mention that stock valuations are somewhat “rich”, but that did not stop the stock markets.

Also, the BOJ’s governor spoke up in the ECB’s conference in Portugal. He stood out by not being optimistic: Carney, Draghi, and Poloz were all optimistic.

On the political front, Trump’s health care bill was retracted by Senate Republicans after they failed to muster support. This setback implies a delay in tax reform that the dollar wants to see. However, it may also be temporary.

Busy start to July, Q3, and H2

The upcoming week opens the second half of the year and it’s with a bang. We have a full build up to the US Non-Farm Payrolls, with a small break for the 4th of July festivities. And, the Fed releases its meeting minutes, which may be somewhat less optimistic than the statement.

See all the main events in the Forex Weekly Outlook

In Japan, the Tankan indicators are worth mentioning: these are released on Sunday at 23:50 GMT. However, as usual, the US indicators will drive the pair more than anything else.

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

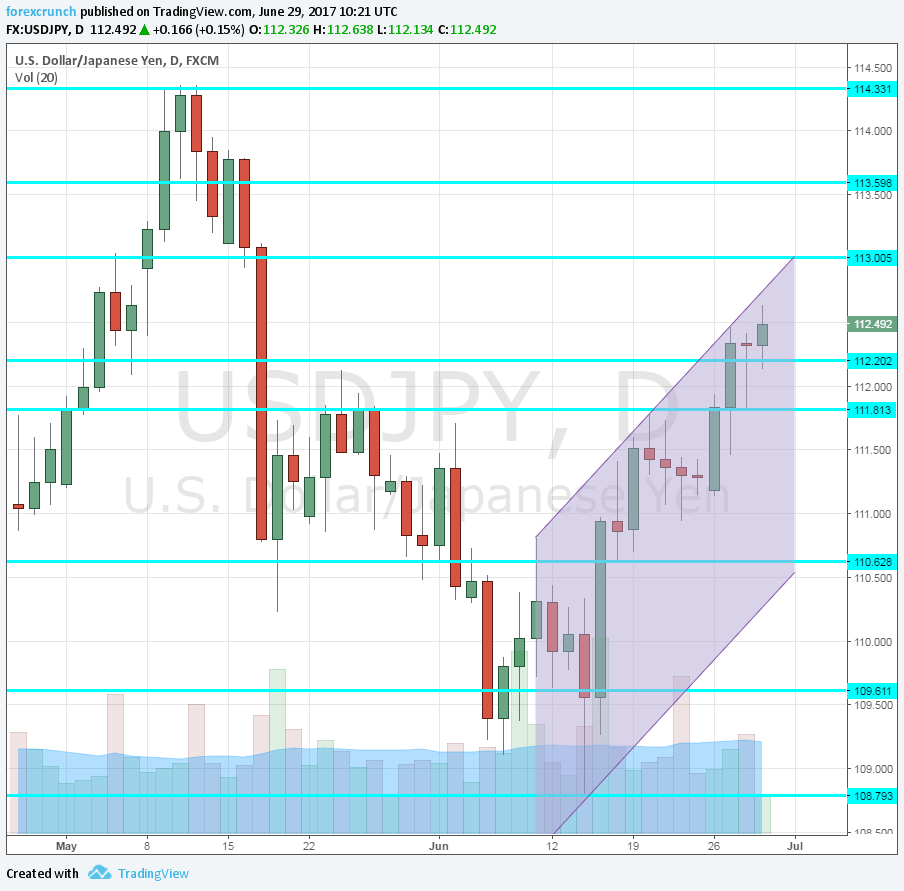

The pair is now trading in a higher range. The bottom is 112.20 that worked as resistance in April and May. It is very closely backed up by 111.80 that served as resistance in the past. The top is 113, a round number that was also the bottom when the pair traded at a higher range.

Further resistance is at 113.60 which served as resistance in the past. The cycle high of 114.30 is a strong level of resistance, the highest since March. Further above, 115 and 115.35 are notable.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

Downtrend Channel

As the chart shows, the pair is experiencing lower highs and lower lows, forming a downtrend channel since the end of May. The lower highs are more significant than the lows.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

While the Federal Reserve is more dovish than the perceived hawkishness seen in the recent rate decision, the BOJ is not less dovish.

Our latest podcast is titled Markets are finally moving – will it last?