USD/JPY posted sharp gains last week, surging 370 points. The pair closed at 111.76, its highest weekly gain since late March. There are six events on the calendar this week. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

The oil summit in Qatar, which failed to produce an agreement, resulted in volatility for the Japanese yen. The currency initially gained ground after the inconclusive meeting but lost ground as oil prices stabilized. In the US, jobless claims sparkled, but manufacturing and housing reports missed expectations.

do action=”autoupdate” tag=”USDJPYUpdate”/]

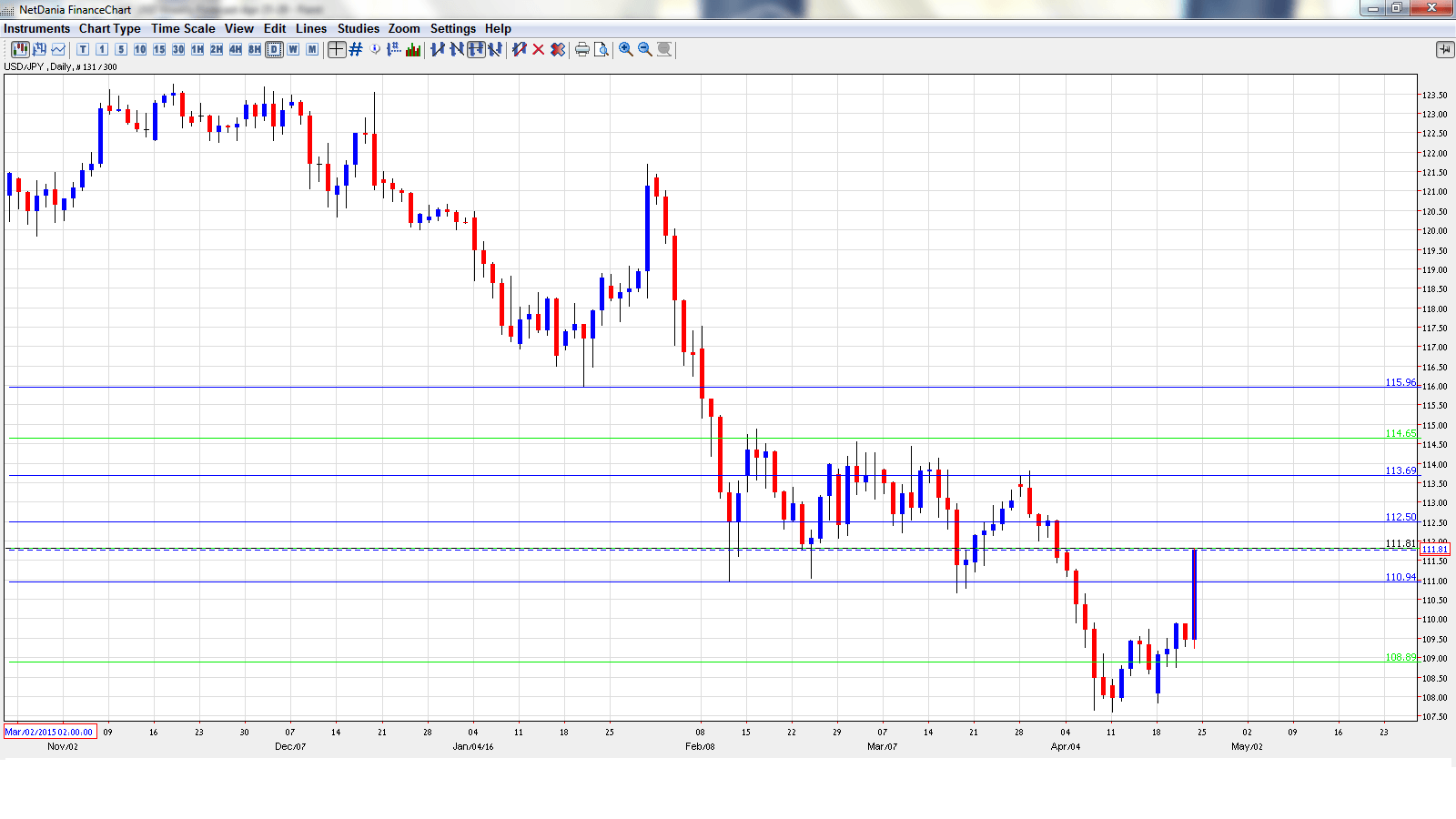

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- SPPI: Sunday, 23:50. This inflation index has been steady, posting two straight readings of 0.2%. An identical reading is expected in the March release.

- All Industries Activities: Wednesday, 4:30. After posting two declines, the indicator rebounded in February with a strong gain of 2.0%, within expectations. The markets are braced for a sharp downturn, with an estimate of -1.3%.

- Household Spending: Wednesday, 23:30. Consumer spending is a key engine of economic growth and is closely monitored by analysts. The indicator rebounded in February with a strong gain of 1.2%, breaking a nasty streak of five consecutive declines. The markets are bracing for a downturn in March, with an estimate of -4.0%.

- Tokyo Core CPI: Wednesday, 23:30. Inflation levels remain low, and this key inflation indicator has posted three straight declines. Another soft reading is expected in April, with an estimate of -0.3%.

- Retail Sales: Wednesday, 23:50. Retail Sales is the primary gauge of consumer spending, and an unexpected reading could have a strong impact on the movement of USD/JPY. The indicator posted a gain of 0.5% in February, below expectations. The markets are expecting a sharp downturn in the March report, with the estimate standing at -1.4%.

- Monetary Policy Statement: Thursday, Tentative. The BoJ has been under pressure to take monetary steps to bolster the economy, and interest rates cuts is one option available to the BoJ. As well, the BoJ will release a quarterly outlook report which discusses economic conditions and the inflation picture.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 108.06 and quickly touched a low of 107.76, as support held firm at 107.39 (discussed last week). The pair posted sharp gains late in the week, touching a high of 111.81. USD/JPY closed the week at 111.76.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

With USD/JPY posting sharp gains, we start at higher levels:

115.90 was an important cushion in the second half of 2015.

114.65 is the next resistance line.

113.71 has held firm in resistance since late March.

112.48 is a strong resistance line. The line marked the start of a yen rally in January 2008, which saw USD/JPY drop below the 100 level.

110.94 was a cushion February.

108.95 was a cushion in May 2006. It is a weak resistance line.

107.39 is providing support.

106.25 marked the start of a dollar rally in October 2014 which saw USD/JPY move above the 121 line.

I am bullish on USD/JPY

Any further easing steps by the BoJ would likely weaken the yen, but the central bank may have run out of monetary ammunition and could remain on the sidelines this week. In the US, the Fed is unlikely to make a move in April, but a June hike is on the table, so monetary divergence continues to favor the US dollar.

In our latest podcast we ask: is China out of the woods?

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast