USD/JPY posted sharp gains for a second straight week, as the pair closed at the 104 line. There are just two events this week. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

In the US, retail sales were a mixed bag, but the greenback was boosted by the Fed minutes, which indicated that a December hike is a strong possibility. In Japan, BoJ Governor Haruhiko Kuroda said that the bank was unlikely to meet its inflation target goal before 2018, but had no plans to change its radical easing program.

do action=”autoupdate” tag=”USDJPYUpdate”/]

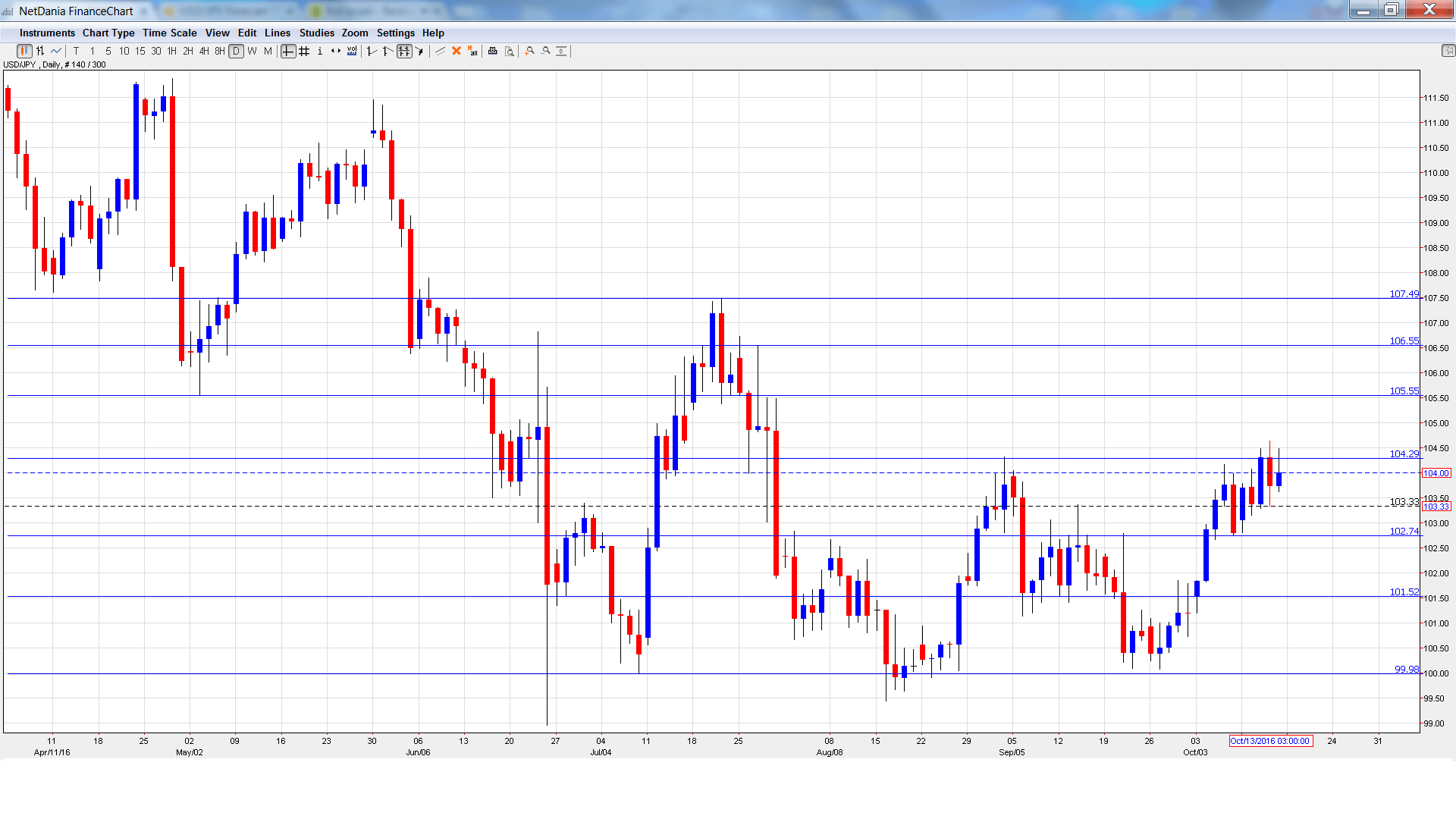

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Revised Industrial Production: Monday, 4:30. The indicator declined 0.4% in July, missing the estimate of 0.0%. The markets are expecting a strong turnaround in the August report, with an estimate of 1.5%.

- All Industries Activity: Wednesday, 4:30. This minor indicator softened in July, posting a gain of 0.3%, which was within expectations. The estimate for August stands at 0.2%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 103.04. The pair quickly dropped to a low of 102.80 early in the week. USD/JPY then reversed directions and climbed to a high of 104.64, testing resistance at 104.25 (discussed last week). The pair closed the week at 104.00.

Live chart of USD/JPY:

Technical lines from top to bottom:

We start with resistance at 107.49, which was the high point in July.

106.55 is next.

105.55 was a cushion in May and June.

104.25 was tested in resistance as the pair posted sharp gains before retracting.

102.74 is providing support.

101.52 is next.

99.98 has held in support since late August. It is the final support line for now.

I am bullish on USD/JPY

With the BoJ acknowledging that monetary easing will continue, the yen could continue to weaken. US numbers have generally been positive, and growing speculation of a December hike is bullish for the greenback.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.