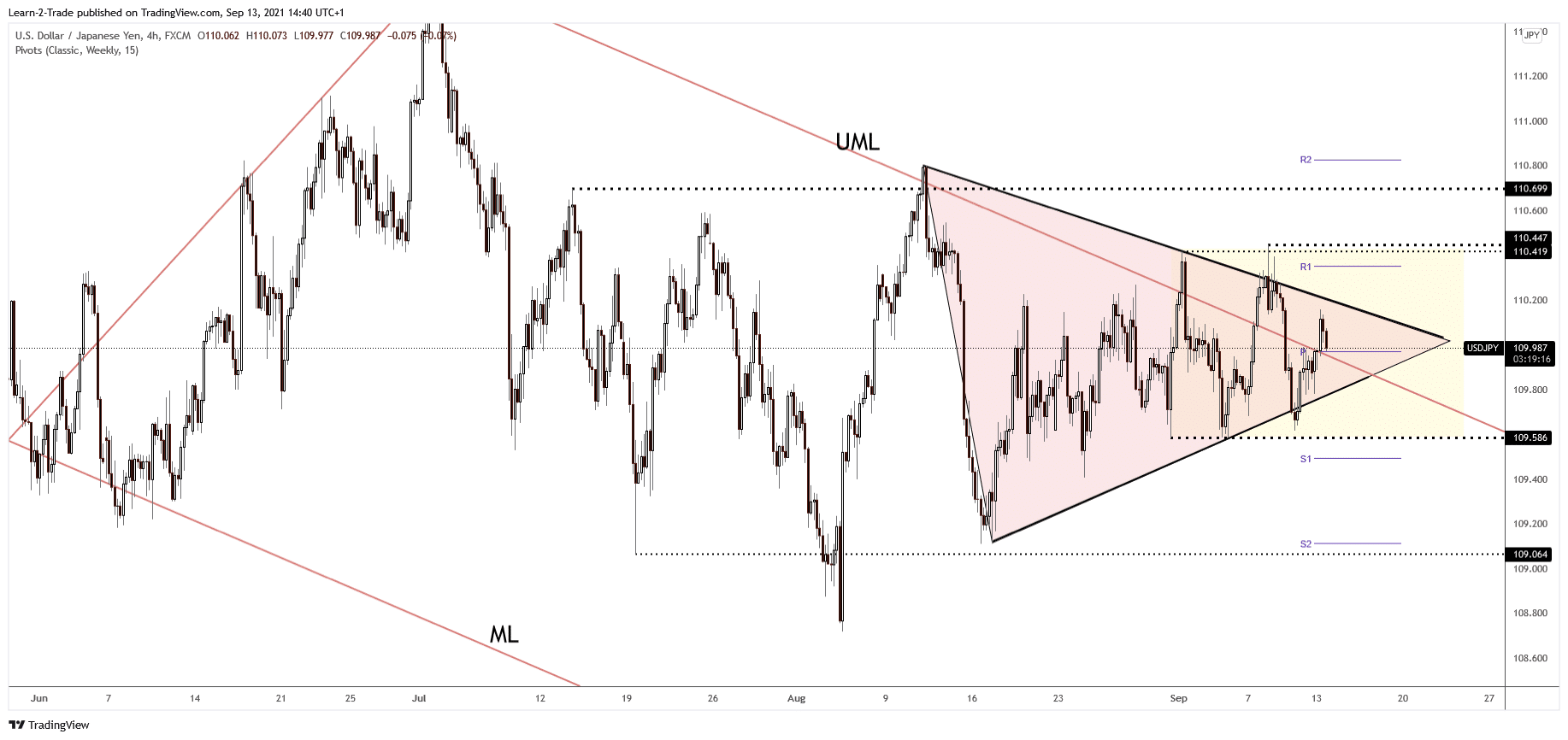

- The USD/JPY pair is trapped within a symmetrical formation; a valid breakout brings great opportunities

- Technically, only a valid breakout from the range pattern could really validate an upside or a downside movement

- US inflation data release on Tuesday could be decisive event

Today’s USD/JPY forecast sees the pair falling at the time of writing after finding strong supply at 110.15 level.

The price continues to move sideways in the short term with market participants displaying a lack of conviction. With the pair having developed a symmetrical triangle, a valid breakout could bring with it trading opportunities.

As things stand it is probably premature to go long or short while this trading pattern persists. For those who dow wish to try their hand at forex day trading, read our guide before you jump in.

3 Free Crypto Signals Every Week – Full Technical Analysis

The price has firmed in the short term after the United States PPI and the Core PPI indicators came in better than expected data on Friday.

Unfortunately, the downward pressure is still substantial, so we cannot exclude a decline as the Dollar Index (DXY) and the Japanese stock index (Nikkei) are trading in the red.

Fundamentally, the Japanese PPI was released in the early morning and it has registered a 5.5% growth versus 5.7% expected, while the BSI Manufacturing Index was reported at 7.0 points above -0.9 estimated.

Tomorrow, Japan is set to release the Revised Industrial Production, which is expected to fall by 1.5% in July.

Still, USD/JPY is likely to be significantly impacted by the US inflation data. The CPI and the Core CPI could bring sharp movements and volatility, especially if inflation is shown to be running hotter than economists forecast.

Automated forex trading is one way to position to profit from market-moving economic calendar events such as US inflation data release, so read out guide on how to get started with the best tools and strategies.

USD/JPY Forecast, Technical Analysis: Breakout Imminent

The USD/JPY pair is still trapped within the triangle’s pattern. It has failed to reach and retest the pattern’s upside line and now is located below the weekly pivot point (109.97) level. It’s pressuring the descending pitchfork’s upper median line (UML).

A decisive breakout from this formation could bring traders great long or short opportunities, but tread carefully because the USD/JPY pair is also trapped between 110.41 and 109.58 levels. Escaping from this range could confirm the future direction of travel.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.