Dollar/yen began the week with a downfall, but the improvement in the fate of the dollar triggered a massive turnaround. Yet another missile firing from North Korea sent the pair down, but this proved to be a buying opportunity. After settling above 110, what’s next for the pair?

USD/JPY fundamental movers

Everything looks better for the dollar

The US dollar was pressured quite hard. While the data was only OK at best (inflation didn’t fall, but retail sales disappointed), the turnaround came from politics.

Trump extended his cooperation with the Democrats. After kicking the can down the road on the debt ceiling and government shutdown, the second deal around DACA already triggered hopes for a massive bipartisan tax reform. In addition, Florida escaped the worst of Hurricane Irma and the optimism for a rate hike from the Fed increased.

For the yen, the markets provided their regular safe-haven flows after North Korea fired another missile. However, the reactions are becoming ever more short-lived.

Fed decision

The major event for the upcoming week is clearly the rate decision by the Fed. One thing is clear: they are going to begin reducing the balance sheet. But what about rate hikes? Given the small beat on inflation, the odds for a December hike are closer to 50-50. What will Yellen say?

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

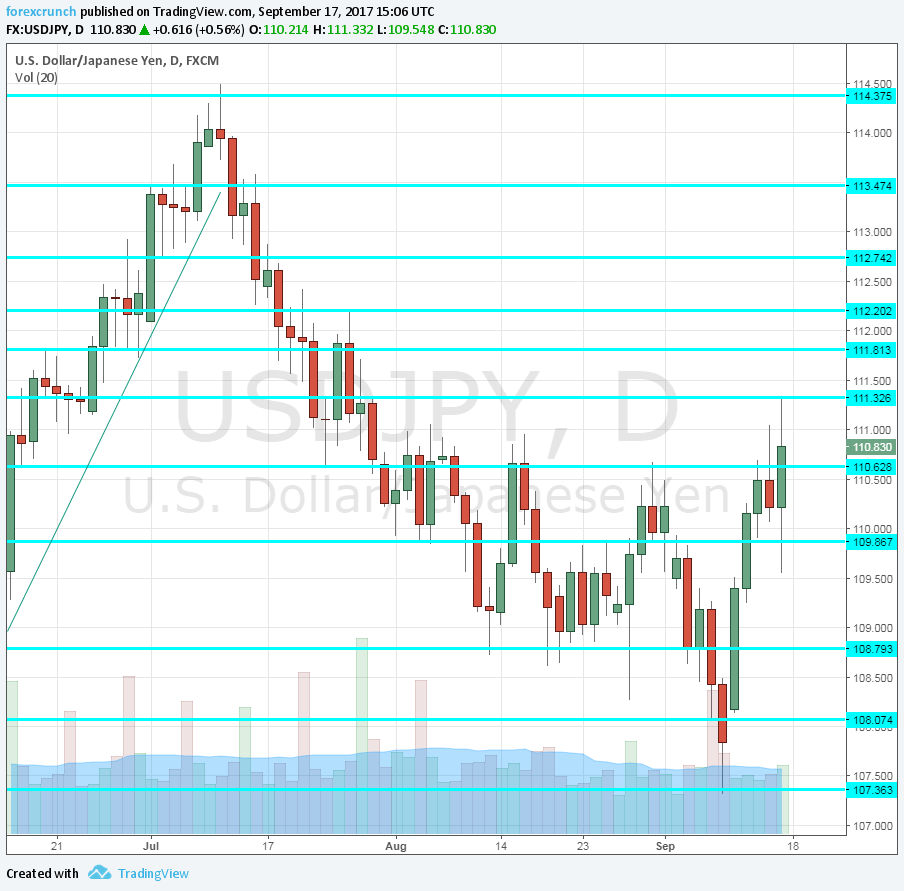

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May. The swing high of early September at 111.30 serves as another point of interest.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

The trough of 107.35 seen in early September serves as another cushion on the way down.

Looking lower, we are back to levels seen in November, but the door is basically open to 105.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

After the false break to the downside, caution is warranted. While the Fed could send the dollar down, the yen doesn’t react that much to geopolitical trouble.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!