Bitcoin trading is becoming more mainstream with futures trading. After the CBOE introduced the option last week, trading at the larger CME group began yesterday. That brought about some stability, at least for now.

The option of going short allows, well, shorting the crypto-currency, aka betting the price will fall. Yet it also allows hedging against such a downfall, therefore allowing more buying of the asset itself. So far, we are seeing some stability in BTC/USD, just under the $19K.

While mainstream and maturity are great for some, others want more action. And there is more than one bitcoin. One of the big drivers of the bitcoin rally we have seen of late was the fork: splitting bitcoin between rival groups. BTC/USD is the mainstream one, but bitcoin cash, BCH, is gaining traction as well.

The advantage of bitcoin cash is that it has a much bigger block size of 8MB, thus making transaction costs much cheaper. The recent interest in the more mainstream bitcoin makes transaction costs expensive and waiting for a confirmation last some 12 hours in some cases.

Emil Oldenburg, the guy behind the website bitcoin.com says this makes BTC unusable, and he has a point, even though he has a vested interest.

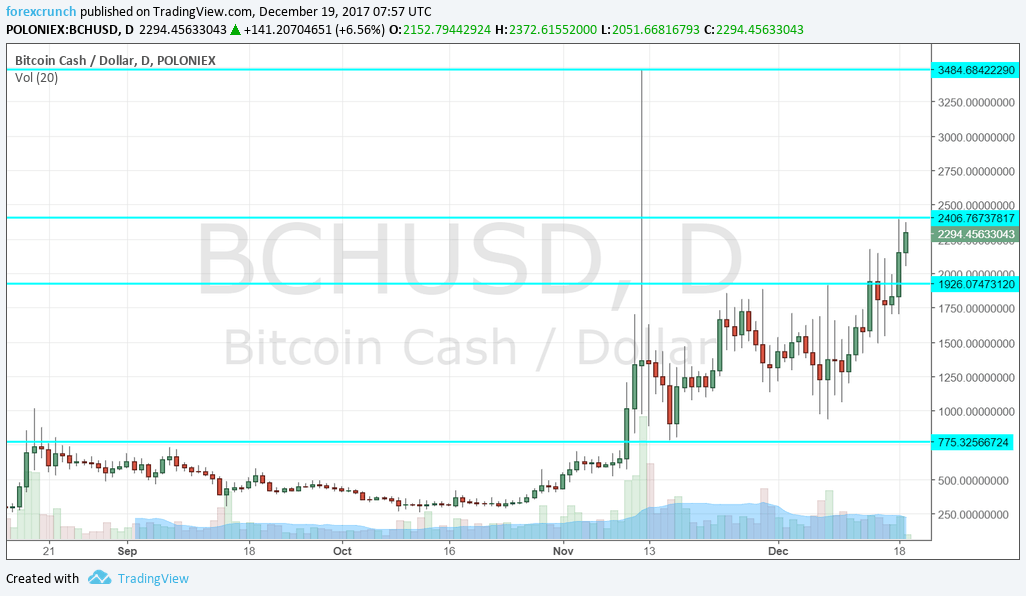

Bitcoin Cash currently trades at around $2,300 after reaching a high of $2,406 earlier in the week. A spike to $3,484 was recorded in November but seemed premature. The current rise looks more gradual, thus having a better basis. Support awaits at $1926 and $775.

Here is the BCHUSD daily chart: