The New Zealand dollar dropped from the highs and basically marked a double top. The focus this week is clearly the rate decision. Will the RBNZ hike or not? Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

It was a bad week for the kiwi: inflation came out below expectations with only 0.3% q/q and only 1.6% y/y, below 1.8% expected. With no real advance in inflation, doubts float about the next move of the central bank. In addition, another milk auction saw another drop in prices, and this is critical for the economy. In the US, the Fed is edging closer to an exit, with the hawkishness coming from a warning about some “stretched valuations” of some sectors in the stock markets.

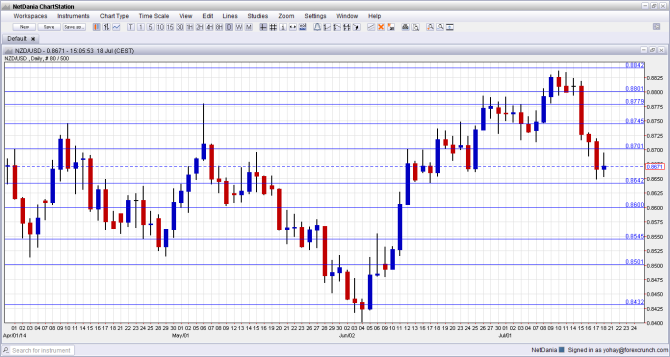

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Visitor Arrivals: Sunday, 22:45. Tourism plays a major role in New Zealand’s economy, so the number of arrivals has an impact. After a rise of 0.3% in May, a bigger advance is likely in June.

- Credit Card Spending: Monday, 3:00. With the country reporting retail sales only once per quarter, this gauge of consumer spending fills the gap. After an annual leap of 7.5% in May, only a small increase is likely in June.

- Rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand raised the rates three times in a row, from 2.50% to 3.25% in order to curb inflation expectations amid a heating economy. It also maintained a hawkish bias in the last meeting, raising expectations for yet another rate hike now. However, the high value of the kiwi is hurting exports and also weighing on inflation, as we have just been informed. On this background, the RBNZ could pause now. The consensus is moving towards that direction, but it is not fully priced in and could undercut the kiwi. A hike would boost it.

- Trade Balance: Wednesday, 22:45. New Zealand enjoys a trade surplus for 7 consecutive months and this is likely to continue for the 8th time. After a lower surplus of 285 million in May, an even smaller margin is likely for June: 155 million.

- ANZ Business Confidence: Friday, 2:00. After reaching a multi-decade high above 70 points in February, it has all been downhill for business confidence, with June’s number standing at 42.8 points. A stabilization is likely now.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started the week on high ground, but it then collapsed. After losing the 0.8780 line (mentioned last week), the pair could not recover and even dipped below 0.87.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

We can look beyond the multi year highs, and the clear line above is the round 0.90 line. Beyond this level, 0.92 could be eyed.

And at charted territory, 0.8840. This is the ultimate line of resistance, that capped the pair back in 2011 and once again in July 2014.

The May peak of 0.8780 is a very important line: the kiwi hesitated towards this line in June. The previous 2014 peak of 0.8745 is now weaker resistance after being broken.

The round number of 0.87 proved its strength during May and is now a pivotal line. The older swing high of 0.8640 worked as a pivotal line but eventually capped the pair.

It is followed by the round number of 0.86, which worked as a cushion during May 2014. The low of 0.8550 served as yet another pivotal line in the range.

I remain bearish on NZD/USD

The RBNZ wants a weaker kiwi, and now gets a justification for that, with a weaker rate of inflation that allows it to take a pause. Together with the slightly more hawkish Fed in the US, it seems that the correction is not over yet.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.