The US dollar has been on the back foot, mostly due to the worries of “President Trump” that were exacerbated by Friday’s FBI effect. It has indeed reversed its gains, especially against the euro.

However, there are good reasons to believe a change is coming for the greenback. Here are three reasons, and a bonus one regarding EUR/USD:

- Trump is not trumping: The polls have clearly tightened for Donald Trump, and Hillary Clinton is on the back foot, spending money in states that were long considered safe, such as Michigan and Wisconsin. On the other hand, the same polls still show her leading both in the national average (having around 70% chance of winning) and in the key states that Trump must win to give him a chance, such as Pennsylvania and Colorado. Also, the momentum from Friday could be waning: news outlets get tired of repeating the same news, particularly since there’s not much fire behind the smoke. And, over 30 million people have already voted, with the Clinton camp leading the ground game. Recent swing state polls favor Clinton. Six days is a lot of time, but Trump’s momentum hasn’t changed the bottom line. See all the updates on the US elections.

- Data is good: The ADP NFP missed with 147K, 21K below expectations. Beneath the headline, there is a whopping upwards revision for September worth 48K which now stands at 202K. A mediocre result in Friday’s NFP could be accompanied by a good revision, and more importantly, the bar is low for Fed hike. In addition, the ISM manufacturing PMI beat expectations, with a rise also in the employment component, raising hopes for a solid report on Friday.

- Fed inching towards a hike: While the Fed did not want to rock the boat ahead of the elections, they did take another baby step towards a hike. First, they said the case for a hike “continued strengthening.” Also, they now only need “some” more evidence, not too much needed. According to bond markets, the chances of a hike have moved up from 68% to 72% now: a small move, but in the dollar-supportive direction.

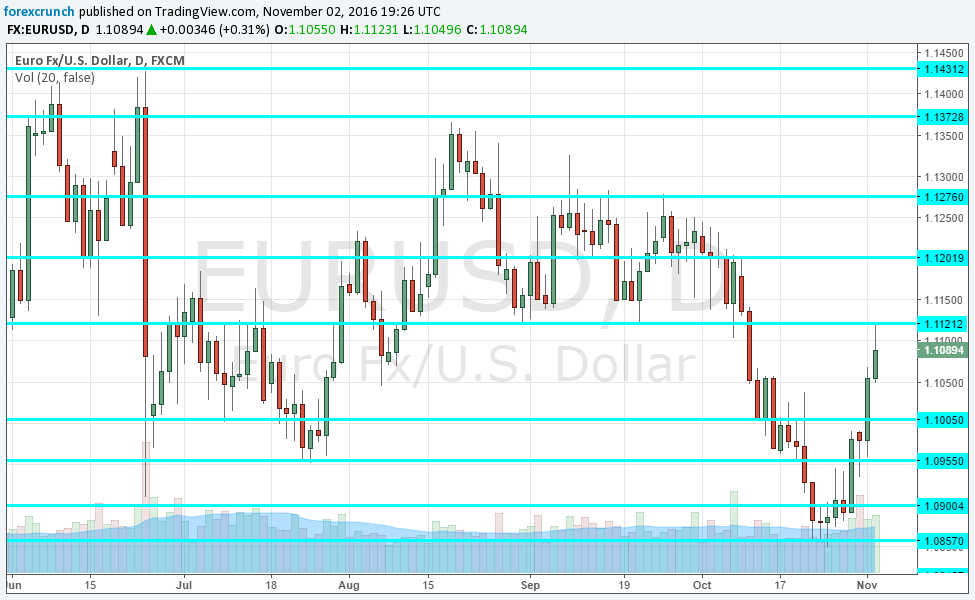

And regarding EUR/USD, it has been clearly rejected from resistance. The 1.1123 level served as a floor under the previous high range for the pair. It was touched in August and then in September, a double-bottom. In the recent surge, we reached exactly 1.1123 before the pair dropped, trading at 1.1090 at the moment. We rarely get resistance or support levels working with such an accuracy.

The chart speaks for itself. More: EUR/USD: Staying Short: 4 Macro Reasons Plus Technicals – Credit Suisse