Authorities in South Korea are considering closing down exchanges of cryptocurrencies. This is one of the measures considered by the Asian country which is one of the hot spots of digital coins. They want to stop excessive speculation or “irrationally overheated” as Korea’s Office of Policy Coordination says.

South Korea’s PM recently expressed concern about the impact of trading on the nation’s youth. Trading volume may be around 20% of global trading in the world’s 12th largest economy. Another proposed measure would be requiring real-name transactions.

The result is a significant fall in the value of all these coins, with some taking it harder than others. Coins crashed on Friday in a much harsher manner. Here are some updates:

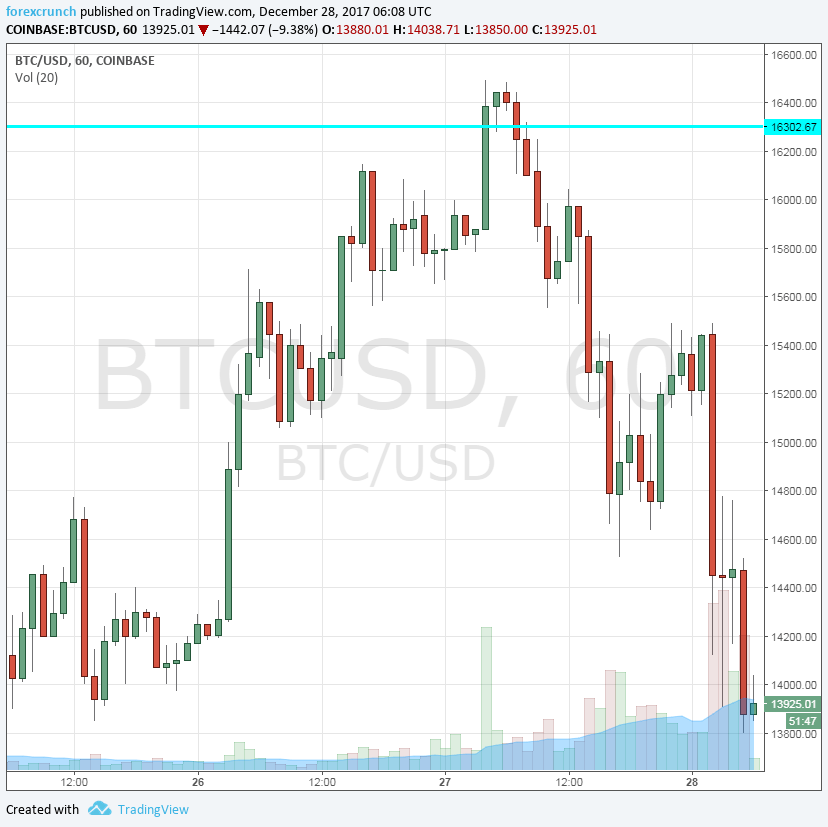

- Bitcoin: BTC/USD is down some 10%, trading around $13,850 at the time of writing. The world’s No. 1 crypto is finding it hard to approach the new highs since futures trading was introduced last week.

- Ripple was already roaring to new highs, breaking $1.25 and standing out against its peers. It is now back to the previous range of 1.10 to 1.18.

- Ethereum: ETH/USD is down only some 7% to $685. This sophisticated coin was struggling to hold onto the support lines and eventually surrendered as well.

- Litecoin: LTC/USD is down some 9% to $239. Volatility has been quite significant here.

- Bitcoin cash: BCH/USD is down around 11%, following the footsteps of BTC and trading around $2,415.

More: A Future Prediction on Cryptocurrencies

Here is how the fall looks on the BTC/USD hourly chart: