- AUD/USD manages to shed off partial losses despite poor retail sales.

- Risk sentiment deteriorates amid blast at Kabul airport.

- The infection rate in the country has dropped, supporting Aussie as a result.

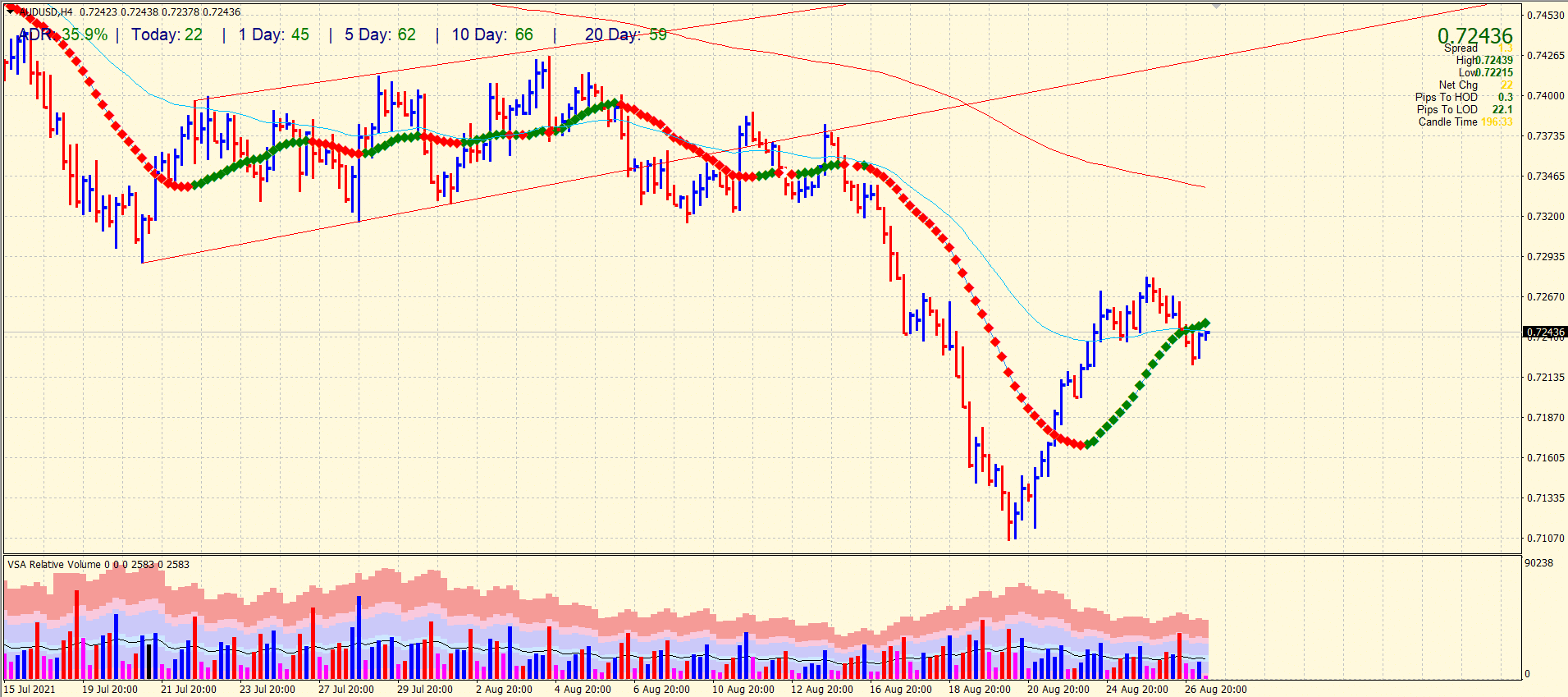

The AUD/USD price analysis shows a recovery. However, the bulls are too weak to maintain the momentum beyond 0.7250 area.

Although Australian retail sales in July were worse than expected at the beginning of Friday, bids for AUD/USD rose to 0.7245, cutting intraday losses to 0.08%. Consolidation movements may have occurred in anticipation of key events in a quiet session.

In Australia, retail sales fell from -1.8% to -2.8% this month compared to -2.3% last month.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Risk appetite was affected the day before by the Fed’s latest peak and concerns about Afghanistan and China, which weighed on the AUD/USD exchange rate. Nevertheless, recent actions have been limited by the crowded calendar in Asia and the cautious attitude of Fed Chairman Jerome Powell ahead of the Jackson Hole symposium.

“The purpose and timing of Fed bond-buying no longer matched the situation,” said Dallas Fed President Robert Kaplan. In addition, James Bullard and Esther George raised concerns about the gradual reduction in asset purchases.

Several US officials have been injured in the Kabul airport bombing, raising questions about the US response to the Taliban. Instead, a group of ISIS fighters are to blame for the attack, according to US Vice President Joe Biden.

South China Morning Post (SCMP) reported: “Critics claim the US government isn’t doing enough to support Australia in its battle with China.” Another factor hampering AUD/USD pricing are Chinese concerns over deteriorating economic conditions among Australia’s largest buyer.

Covid cases in Australia have fallen from a record 1,130 to 964, and the Covid Technical Advisory Group has recommended vaccinations for children aged 12 and over, despite opposition from the public.

While the 10-year US Treasury yield dropped to 1.34% at the latest, S&P 500 futures posted small losses and continued to follow Wall Street’s benchmarks. Meanwhile, the US Dollar Index (DXY) struggled to continue its recovery on Thursday.

A major US PCE price index for July is set to entertain AUD/USD traders, but they will focus on Powell’s speech today.

–Are you interested to learn more about making money in forex? Check our detailed guide-

AUD/USD price technical analysis: Under pressure below 0.7250

The 20 and 50 SMAs on the 4-hour chart converge to pause the gains under the mid-0.7200 area. The volume supports a bearish wave as the rising bars have very low volume compared to the hidden upthrust bar. So far, the average daily range is 35% done. We may see a downside move towards the 0.7200 area.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.