- AUD/USD has been losing ground amid the firm US dollar.

- The slowdown in the Chinese economy has been affecting the Aussie.

- Traders are eying Australian employment data and Fed’s rate decision this week.

The AUD/USD price tumbled to the daily lows of 0.7250, losing around 0.50% at the time of writing. The downside is attributed to the strong US dollar.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Risk sentiment to remain the driving force

The Asia-Pacific market is poised for another potentially volatile week amid ongoing tensions in Ukraine as Russian forces advance towards Kyiv, the capital city. Although the Russian economy is under enormous pressure from Western sanctions, peace talks between the two countries have made little progress. Iron ore prices helped support the Australian dollar last week, reversing weeks of gains for the risk-sensitive currency against the US dollar.

Chinese economy struggling

A slowdown in China’s credit markets may have affected the Australian dollar. China’s People’s Bank (PBOC) announced last week that new yuan loans totaled $1.23 trillion in February. From January, the figure is down when new lending reached a record 3.98 trillion yuan. The data indicates that credit conditions have deteriorated in Asia’s economic engine, which might force Beijing to support additional stimulus shortly. Due to the ongoing conflict in Ukraine, this may help the Australian dollar. However, the central bank may remain cautious.

Australian data

This week’s highlight for APAC will be the employment report from Australia for February. Bloomberg poll respondents expect Australia to add 40,000 jobs in February and the unemployment rate to fall to 4.1% from 0.1%. An improved reading should provide some support to the AUD/USD pair. In addition, gross domestic product (GDP) growth data will be released for New Zealand for the fourth quarter. According to estimates, that figure will rise from -0.3% in the third quarter to 3.3% this quarter.

Fed’s rate hike

Despite this, the US dollar outperformed safe-haven currencies, thanks to its own status as a safe-haven currency. The US Federal Reserve is also expected to hike interest rates by 25 basis points on Wednesday, giving it a rate advantage over the other central banks

In today’s trading, traders may be cautious given the many important events slated for the next few days. However, the situation in Ukraine still has the potential to cause strong volatility in global financial markets.

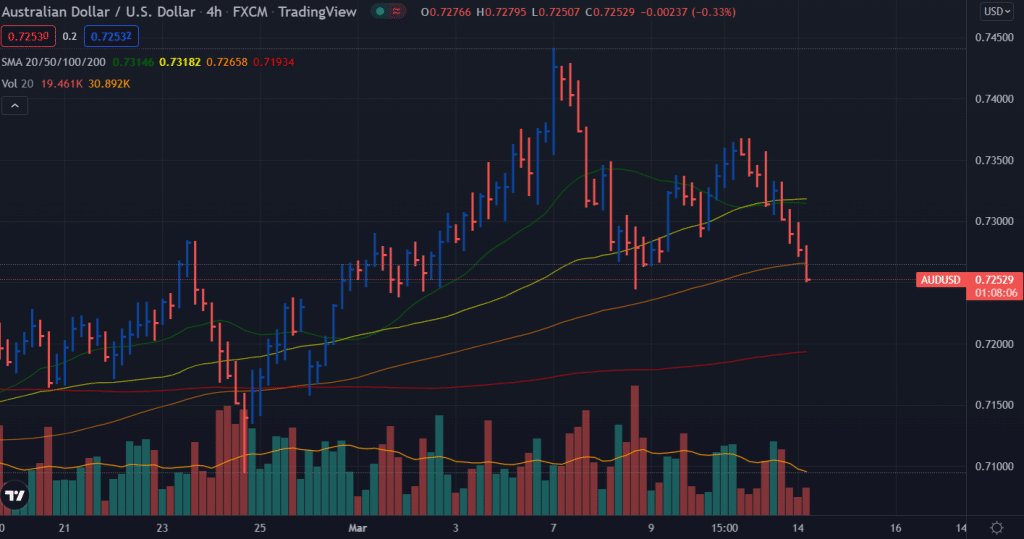

AUD/USD price technical analysis: Bears eying 0.7200

The AUD/USD price tumbled below the 20-period and 50-period SMAs on the 4-hour chart. The pair broke the key supports of 0.7300 and 0.7285. Now the pair is eying at 200-period SMA around 0.7200.

On the flip side, 0.7300 will be the key resistance. The volume is quite low for the recent down bars. It shows the potential for a corrective pullback.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

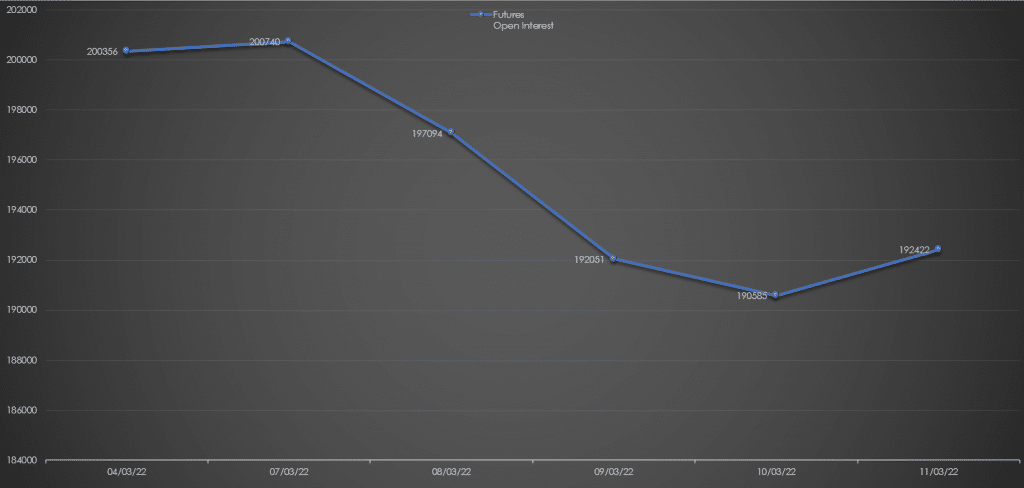

AUD/USD price analysis via daily open interest

The daily open interest went slightly higher while the prices went lower. It indicates a bearish potential for the pair.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money