A new week begins with new weakness in the US dollar. USD/JPY is at the lowest in a month, USD/CAD is looking at the lows and even GBP/USD is recovering. The Australian dollar stands out with the largest percentage-wise gains.

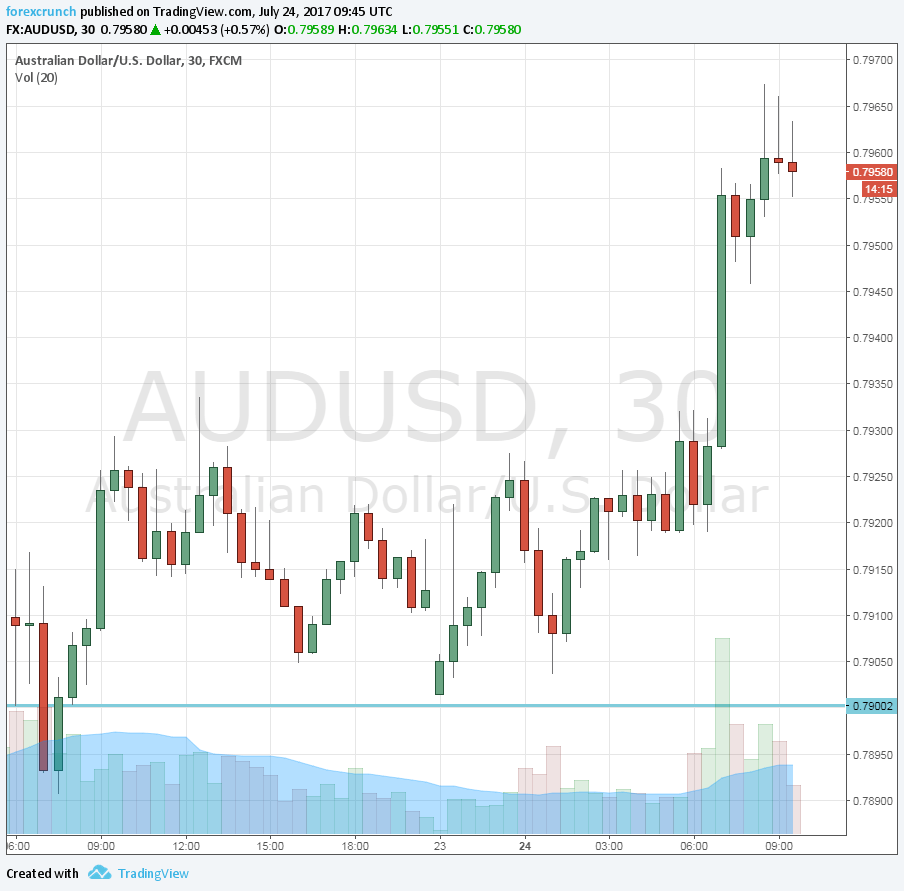

AUD/USD is trading around 0.7960, still below the spike high of 0.7987 that was recorded last week. Can it make it to the very round number of 0.80?

The Aussie jumped higher on the hawkish meeting minutes from the RBA. An attempt to play them down did little harm to the Aussie. However, a risk for further advances may come from the central bank. They certainly do not want to see a strong A$.

The RBA officials will hope for the CPI to remain stable, or at least that the market reaction will be negative to the Aussie.

US political dramas continues

But they don’t have control of the US side of the equation. The greenback remains on the back foot due to the data, the Fed and also politics. We will hear from the Fed on Wednesday, with the rate decision. They are expected not to rock the boat, but markets will focus on one word: transitory, regarding inflation.

Regarding politics, we know that Paul Manafort, Donald Junior, and Jared Kushner will all testify this week, but behind closed doors. We do not know what additional political developments may or may not occur. A last ditch attempt to push the health care bill is on the cards.

AUD/USD levels to watch

What happens if the AUD/USD makes the move above 0.80? Resistance awaits only 0.8165 and 0.83. These are levels from 2015.

On the downside, we have 0.79 and 0.7835, the previous cycle’s high.