The British pound shared the fate of the euro, and enjoyed a very strong ride. The upcoming week is very busy, with the first release of Q3 GDP being the highlight. Here’s an outlook for the upcoming events, and an updated technical analysis for GBP/USD.

The pound also enjoyed a relatively small current account deficit. This provided a boost for the pound.

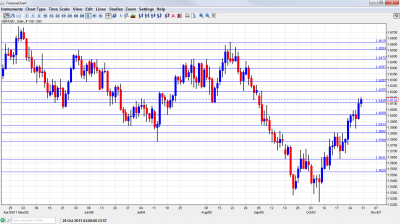

GBP/USD daily graph with support and resistance lines on it. Click to enlarge:

- Halifax HPI: Publication time unknown at the moment. This is one of the more accurate house price indices in Britain, as it is based on the internal data held by HBOS, one of the largest banks. In the past two months, the Halifax HPI has pointed to significant falls in house prices. A small rise is likely now.

- Net Lending to Individuals: Monday, 9:30. More lending means more economic activity. After a dip to 0.4 billion three months ago, the level of lending grew once again to more normal levels and hit 1 billion in the past two months. A dip is likely now.

- Nationwide HPI: Tuesday, 7:00. This is a relatively early publication of the changes in house prices, making its impact significant. After a disappointing drop two months ago, prices ticked up by 0.1% last month. A similar and small rise is likely now.

- GDP: Tuesday, 9:30. This is the first release of GDP for the third quarter of 2011. There is a good chance that Britain’s economy contracted. In Q2, the economy grew by only 0.1%. It followed two quarters of an equal growth and contraction at the same scales of 0.5%. If the economy stalled or contracted, the pound is likely to take a hit. A rise of above 0.2% will be good enough for rises.

- Manufacturing PMI: Tuesday, 9:30. This is usually an important indicator that has a strong impact on the pound, but this time it is overshadowed by the GDP release. Britain’s manufacturing sector returned to grow last month with a PMI of 51.1 points, above the 50 point mark. This came after two months in contraction zone. A small dip is likely now.

- Construction PMI: Wednesday, 9:30. The construction sector has been growing at a slow pace for 9 months. Last time it scored only 50.1 points, the minimal growth pace. This time there’s a good chance that it will fall below 50 and enter the contraction zone.

- Services PMI: Thursday, 9:30. The most important sector is kept for last and it provides some hope. It rebounded to 52.9 points last month, reflecting nice growth. A small drop now will still likely keep it above 50 points.

* All times are GMT.

GBP/USD Technical Analysis

Pound/dollar settled above the 1.5910 (mentioned last week) and made initial attempts to break above 1.60. When it finally conquered this line, it managed to move one leg forward and break above 1.61110.

Technical levels from top to bottom

1.6617 was a peak back in August and is a high line this week. It’s followed by 1.6550 that capped the pair during May. The next line was very stubborn during July, 1.6470, and also capped the pair in August.

1.64, which was a pivotal line recently and resistance at the beginning of the year. 1.6285 follows with a similar role. It was also support at one point.

The round number of 1.62 worked in both directions during many months of range trading. 1.6110 is another significant line that served better as support.

The round number of 1.60 is getting closer. Also this line worked well in both directions during 2011. 1.5910, was eventually broken and now switches to support, the same role it had in June.

1.5850 proved to be a tough line of resistance before the recent break higher and now works as support. It is followed by the swing low of 1.5780, a minor resistance in 2010, which is minor support now.

1.5633 worked as support during September was only very temporarily breached in October. It is followed by 1.5530 which was the bottom line of the recent range, and had a similar role back in 2010. It now turns into support.

I am bearish on GBP/USD.

Despite the positive current account number, the rising unemployment with stubborn inflation are weighing on the economy. If GDP contracts, the pound could tumble.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.