The British pound couldn’t escape the debt crisis in continental Europe and slid lower in an exciting week. The upcoming week is very busy, with the rate decision being the star of the show. Here is an outlook for the upcoming events and an updated technical analysis for GBP/USD.

Britain enjoyed some nice growth in Q3, but fresh figures from October are not so good: The manufacturing sector is contracting once again, while construction is doing better and the services sector is struggling.

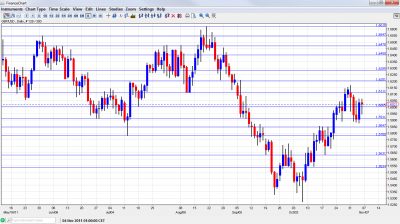

GBP/USD daily chart with support and resistance lines on it. Click to enlarge:

- Halifax HPI: Publication time unknown at the moment. This is considered to be one of the more accurate house price indices available in the UK, as the data is based on real mortgage figures that the bank possesses. The past two months have seen disappointing drops in prices, of 1.2% and 0.5%. A very minor correction is expected now: 0.1%. Another drop in prices may happen now, adding to pressure on the pound.

- BRC Retail Sales Monitor: Tuesday, 00:00. The British Retail Consortium has a good gauge of consumer spending via this figure, which is a “mini retail sales” number. Recent months were a see-saw between rises and drops. After the 0.3% seen last month, October will likely see a drop.

- RICS House Price Balance: Tuesday, 00:00. The balance between house price rises and drops has been negative for quite some time, but it has stabilized of late. No change is expected this time. The balance is expected to remain at -23%.

- Manufacturing Production: Tuesday, 9:30. The level of manufacturing has dropped in the past three months, slowly eroding a big jump seen beforehand. The data reported now, for the month of September, is expected to show a rise of 0.2%. More recent data about the manufacturing sector available through the manufacturing PMI, shows a big drop in October.

- NIESR GDP Estimate: Tuesday, 15:00. This independent think tank has reported a growth rate of 0.5% in Q3 2011, exactly what the government reported later in its first estimate. We will get fresh data for the three months ending in October now, and the figure will likely be lower.

- Trade Balance: Wednesday, 00:00. After a few hard months, the deficit squeezed to 7.8 billion in August, providing fuel for the pound. A similar figure is expected for September.

- Rate decision: Thursday, 12:00. The decision to expand the quantitative easing program in October was somewhat earlier than expected and the size was relatively big: more than Adam Posen voted for during many months. This was the first policy change in a long time and it had a strong impact on the pound. So, Mervyn King and his colleagues are not likely to make additional policy changes at the upcoming meeting, but will probably prefer waiting in order to see the situation in the economy before making new moves. Although it is important to mention that some analysts expect an expansion of the QE program beyond the current scale of 275 billion pounds.

- PPI: Friday, 9:30. Producer prices are very volatile: they jumped by 1.7% last month after dropping by 1.8%. Nevertheless, they provide some guidance for the more important consumer price index released in the following week. No change is expected now in PPI Input, the main figure. Output prices are expected to rise by 0.2%.

* All times are GMT.

GBP/USD Technical Analysis

Pound/dollar had a very erratic week, eventually closing above the 1.60 line (mentioned last week). All in all, the pair lost some ground.

Technical levels from top to bottom

1.6617 was a peak in August and remains the high line this week. It is followed by 1.6550 that capped the pair through May. The next line was very stubborn afterwards, during July, 1.6470, and also capped the pair in August.

1.64, which was a pivotal line recently and resistance at the beginning of the year. 1.6285 follows with a similar role. It was also support at one point.

The round number of 1.62 worked in both directions during many months of range trading and wasn’t approached now. It remains strong. 1.6110 is another significant line that served better as support than resistance, and this was evident now.

The round number of 1.60 was fought over and provides immediate, yet weak support. Also this line worked well in both directions during 2011. 1.5910, was eventually broken and now remains support, the same role it had in June.

1.5850 proved to be a tough line of resistance before the recent break higher and now works as support. It is followed by the swing low of 1.5780, a minor resistance in 2010, which is minor support now.

1.5633 worked as support during September was only very temporarily breached in October. It is followed by 1.5530 which was the bottom line of the recent range, and had a similar role back in 2010. It now turns into support.

I remain bearish on GBP/USD.

Despite the encouraging news about Q3, the European troubles, high unemployment and the growing evidence of a slowdown all weigh on the pound.

If you are interested in GBP/JPY and technical setups for this pair with binaries, see this week’s GBP/JPY binary technical setup.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.