Dollar/yen ticked up for a second week in a row, but didn’t too far. Household Spending, Retail Sales and Tokyo Core CPI are the highlight of this week. Here’s an outlook for the Japanese events closing 2011 and an updated technical analysis for USD/JPY.

Last week Japan’s central bank released its monetary policy statement announcing the continuation of the current easy monetary policy in light of the growing concerns over European debt problems and the strong yen. The BOJ decided to leave its key interest rate near zero and continue to provide liquidity to the markets through government bonds. Will the Japanese economy improve in 2012?

Updates: General dollar weakness is also felt in this pair, with dollar/yen slipping under 77.60. All in all, the pair remains in range.

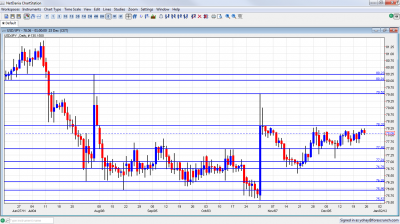

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Monetary Policy Meeting Minutes: Monday, 23:50. Bank of Japan discussed two immediate threats to Japan’s economic recovery; the debt crisis in Europe, badly affecting the manufacturing sector and consequently reducing exports, and the strong yen hurting domestic investment. The BOJ members agreed to maintain rate at 0-0.10% and continue with their lenient monetary policy.

- Housing Starts: Tuesday, 5:00. Housing starts continued to decrease sliding 5.8% in October from a year earlier following 10.8% decline in the previous month. Economists predicted a bigger slide of 6.2%. The negative figures demonstrate the general slowdown in Japan’s economy. Another decline of -4.8% is expected now.

- Household Spending: Tuesday, 23:30. Japanese household spending dropped 0.4% in October from a year earlier following 1.9% decline in September posing the eighth straight month of falls. A bigger drop of 1.1% is predicted.

- Tokyo Core CPI: Tuesday, 23:30. Tokyo Core CPI dropped more then predicted in November decreasing 0.5% after 0.4% decline in the previous month. Bank of Japan Governor Masaaki Shirakawa warned about the negative effect the euro zone crisis may have on Japan’s economy and economic growth will slow considerable this quarter. Tokyo Core CPI is expected to decrease by 0.4% this time.

- Prelim Industrial Production: Tuesday, 23:50. Japanese preliminary industrial production increased by 2.4% in October. This was the first rise in two months following a 3.3% decline in September. On a yearly base production in October rose only 0.1 after falling 3.3% in September. A drop of -0.7% is forecasted.

- Retail Sales: Tuesday, 23:50. Japanese retail sales climbed 1.9% in October from a year earlier amid growing personal consumption. This reading followed a 1.1% decline in the previous month. Economists expected a 0.7% increase. An increase of 0.1% is predicted.

- Average Cash Earnings: Wednesday, 1:30. Japanese salary earners increased by 0.1% in October from a year earlier. This is the first increase in five months suggesting a slight improvement in the market. Overtime pay also increased by 1.8%. A rise of 0.1% is predicted this time.

- Manufacturing PMI: Thursday, 23:15. Japanese manufacturing activity declined in November dropping from the 50 point line to 49.1 after 50.6 in the previous month due to the strong yen and the floods in Thailand decreasing Japan’s output.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen continued the tight range trading and made a smallish move higher. It got relatively close to the 78.30 line mentioned last week, before closing at 78.06.

Technical lines from top to bottom

We start from the same high line: 80.25 was a swing trough in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is the key line on the upside for now.

77.50 is now weaker once again, although it is still of importance after capping fresh attempts to move higher once again during October. It turned into support after the intervention and assumes this role once again. This is the key on the downside.

The round number of 77, remains a significant cap for the range trading that characterizes the pair and proved to be stronger now. 76.75 follows closely after providing strong support of late. Further below we have the swing record low of 76.25 which is still of importance after working well as resistance.

A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I am neutral on USD/JPY.

In the long run, the gradual improvement in the US should push the pair higher. Also the deterioration in Japan, reflected in a trade balance deficit, could aid the pair. But at least during this holiday week, there are much higher chances of seeing the same frustrating range trading.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.